Shopify App : TaxWatch

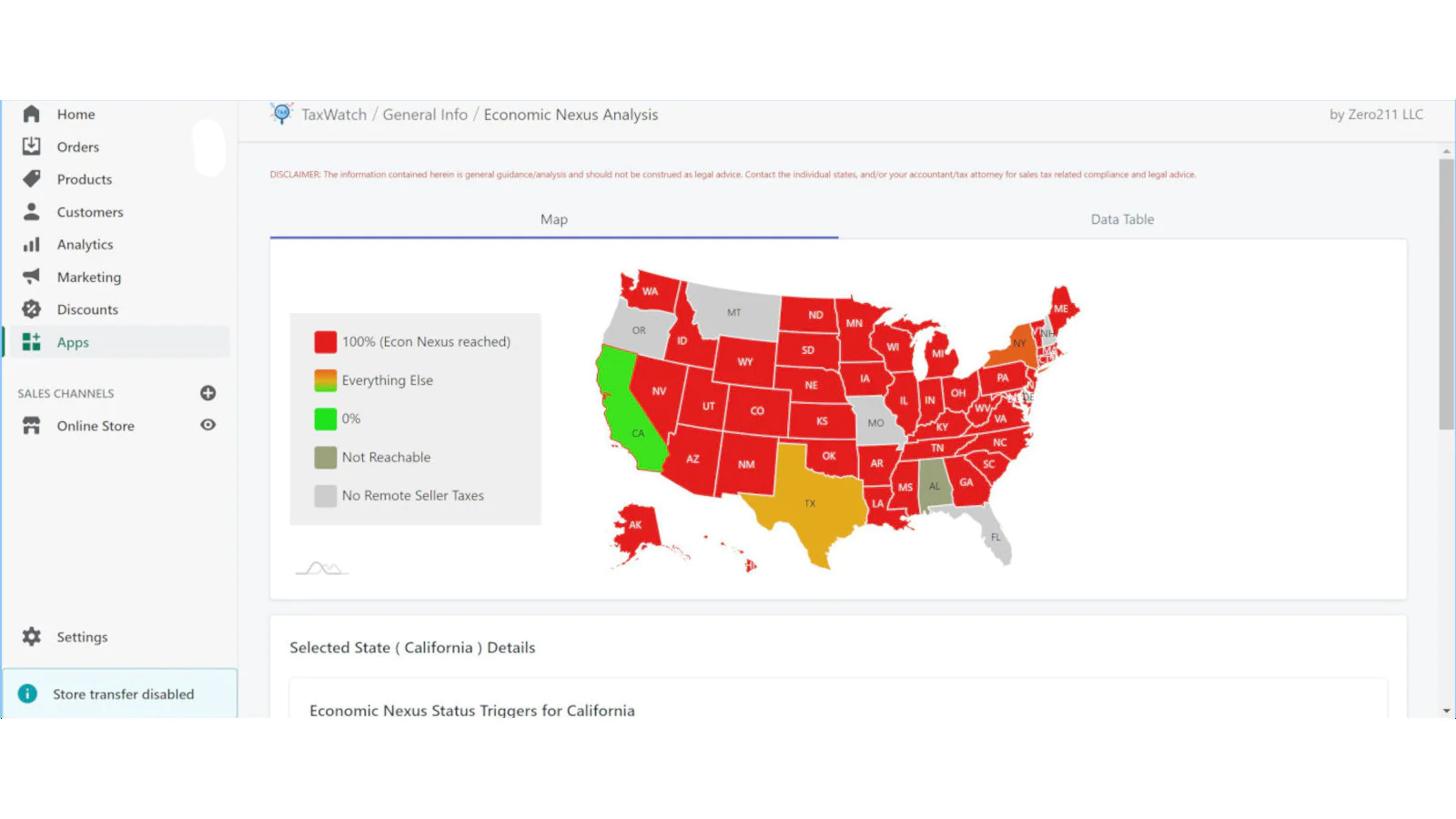

US sales tax economic nexus status analysis showing all states

About TaxWatch

Improve US State tax awareness : See which US States you need to collect sales tax for (or soon will) using our color-coded map and table.

Accountant-friendly : Summary U.S. sales data is exportable to spreadsheets or any program that accepts CSV format for external processing.

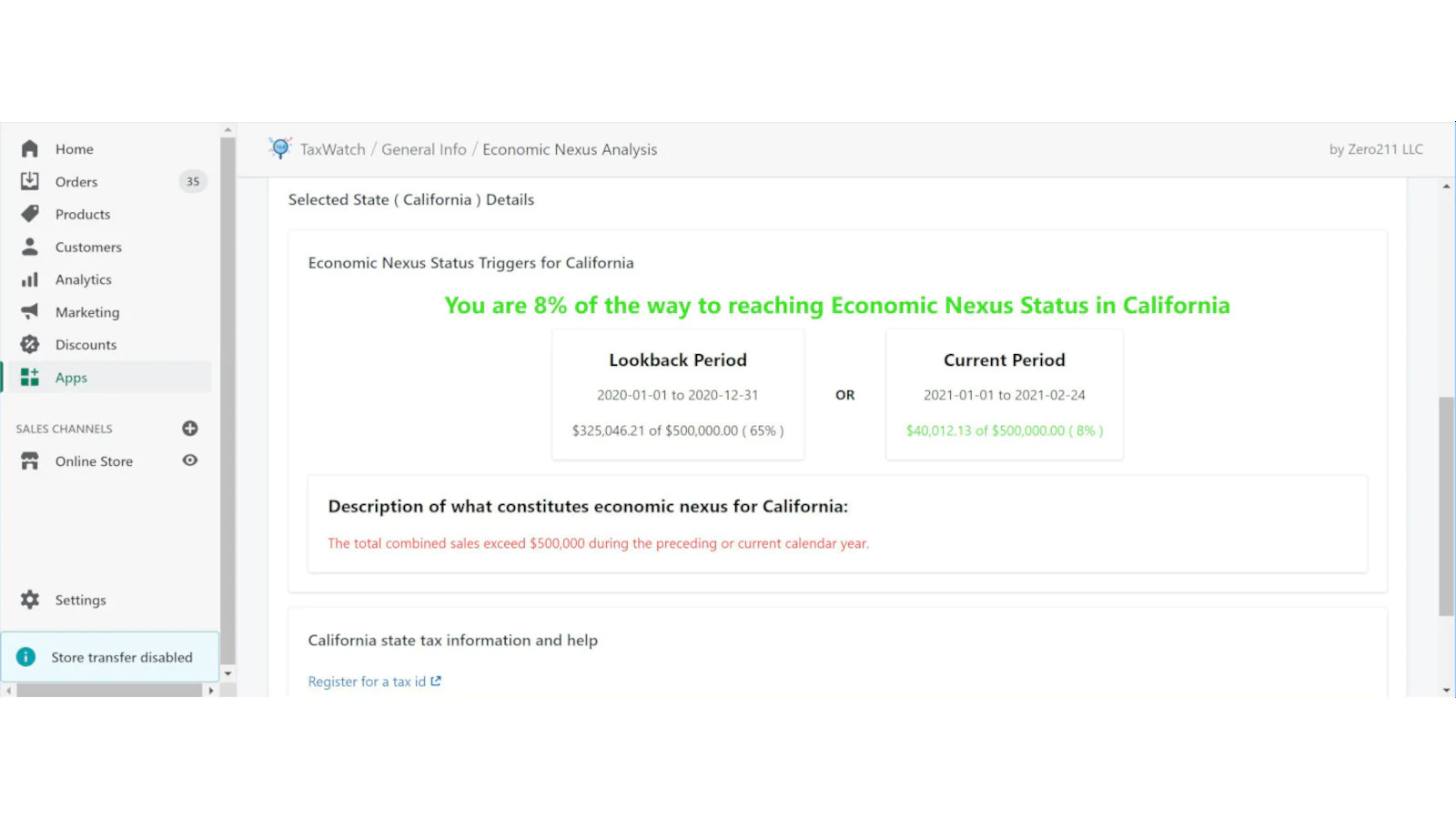

Easy to understand criteria : Economic nexus criteria and helpful tax resource links are provided for each U.S. state.

TaxWatch

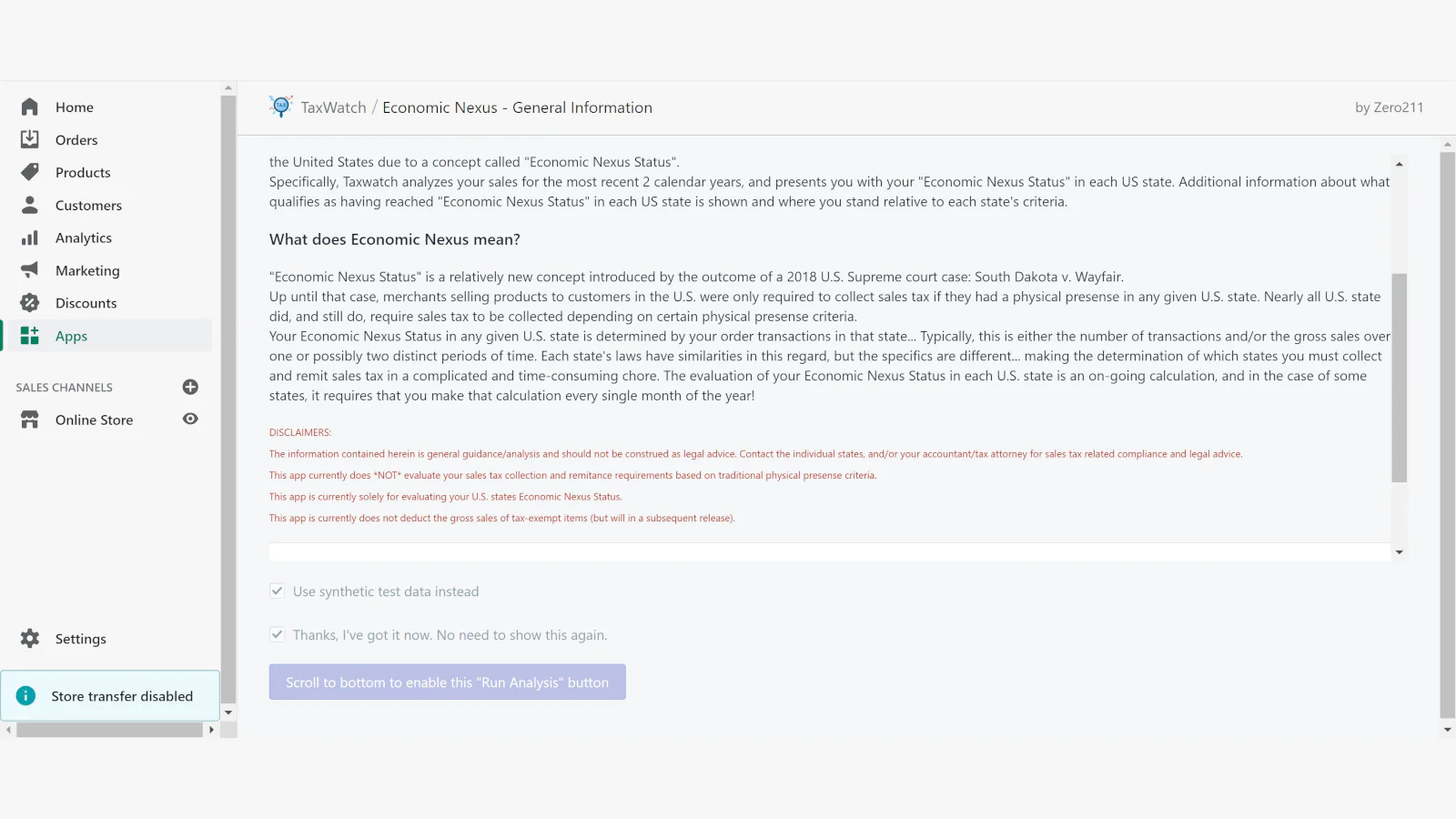

US States sales tax Economic Nexus Status at a glance - without spending a fortune, and without committing to a tax preparer or filing company.

TaxWatch analyzes your order history for the previous two years and determines how close you are to achieving "Economic Nexus Status" for each US State.

Economic Nexus Status is one of the thresholds which indicates whether you are required by law to collect and remit sales tax, for any given US state, as a remote seller. Note that this threshold applies to anyone selling into a given US State, not only those with physical presence there.

Economic nexus is based on gross sales and/or transaction count, over 1 or 2 distinct time periods - and each state's specific rules are different.

Once analyzed (in a matter of seconds), TaxWatch presents the data in an easy-to-understand manner:

A color-coded map of the US which shows each state and Washington DC. This map indicates, at-a-glance, how close you are to reaching economic nexus, and thus required to collect and remit sales tax, for each state. Each state is hover-able and select-able to show any given state's summary and details.

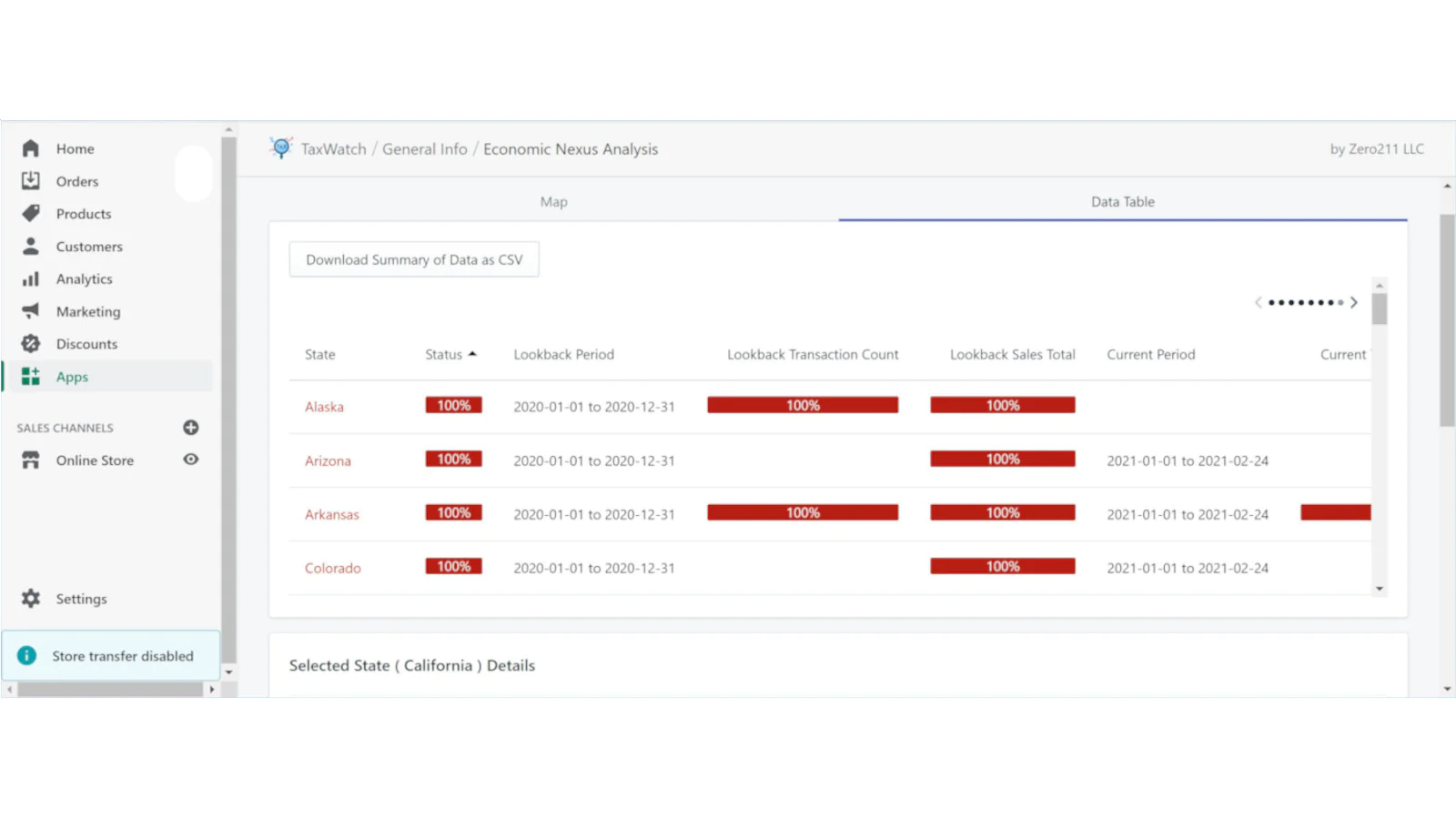

A color-coded summary data table of the US states and DC, showing how close you are to reaching economic nexus status, relative to the current and previous tax period. Each state is selectable to show any given state's criteria, summary and details.

Data shown in the summary data table is exportable to an accountant-friendly CSV file. CSV files can then be imported into external programs and systems, such as well-known spreadsheets and tax programs. Your accountant will thank you.

Helpful URL links and phone numbers for each US state's official tax agency, including pointers to the state's web pages for remote sellers (that's you), how to apply for a tax id, and how to file your collected sales taxes.

Disclaimers:

This app is currently solely for evaluating your U.S. states Economic Nexus Status. This app currently does not evaluate your sales tax collection and remittance requirements based on traditional physical presence criteria.

This app currently does not deduct or separate out the gross sales of tax-exempt items (but will in a subsequent release) from the analysis.

This app currently does not support stores with more than 225000 completed orders over the last 2 years (but will in a subsequent release).

This app provides general guidance and analysis and should not be construed as legal advice. Contact the individual states, and/or your accountant or tax attorney for sales tax related compliance and legal advice.

Seamless workflow: use directly in Shopify admin

About the Author

Matej Kontros is an E-Commerce expert and app developer with over a decade of professional experience in IT.

Matej has worked for organisations of all types and sizes, including global players, startups, and agencies. He designed, developed, and maintained complex projects.

Matej's expertise includes e-commerce, software engineering, web development, systems administration, internet security, managing projects, and building teams.

Visit his website at [ Web Linkedin ] or contact him at [email protected].