Shopify App : Taxdoo

All-in-one EU VAT & Accounting solution with OSS/IOSS exports

About Taxdoo

All-in-One VAT Solution : VAT returns are a breeze with Taxdoo! Our end-to-end solution from tax experts analyses your sales and determines your EU-wide VAT liability

Automated Tax Determination : We show you how, where, and when you have to file for taxes and therefore help you avoid all financial risks.

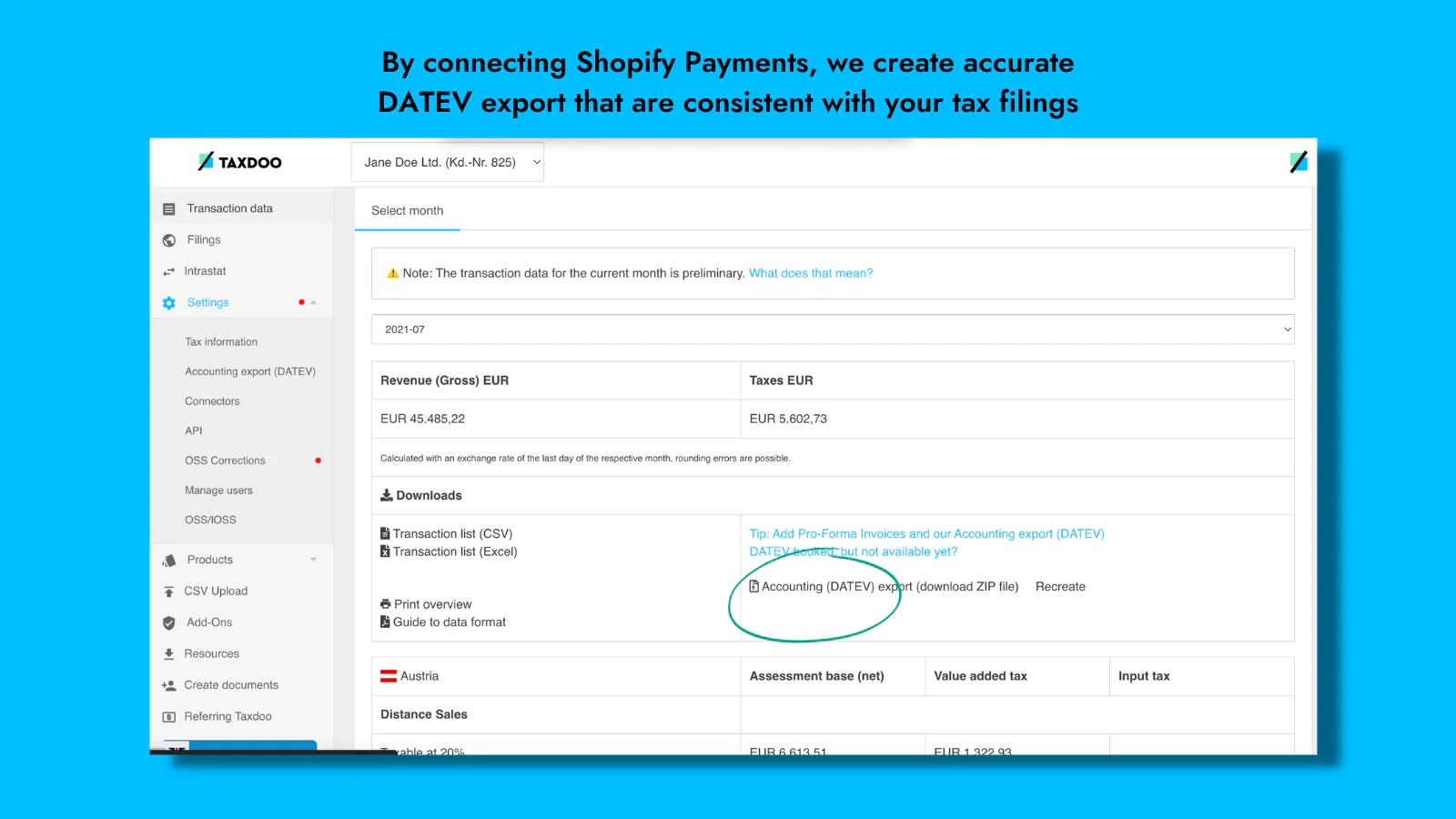

Accurate Financial Accounting : Connect Shopify Payments to automatically import transaction and payment data to create VAT and financial accounting reports.

WHO ARE WE?

Taxdoo is a fully automated VAT and accounting solution for online merchants selling on Shopify and other marketplaces, shop, and ERP systems. Taxdoo’s API-based platform replaces tedious manual tasks and reduces the financial risks of cross-border trade in the EU.

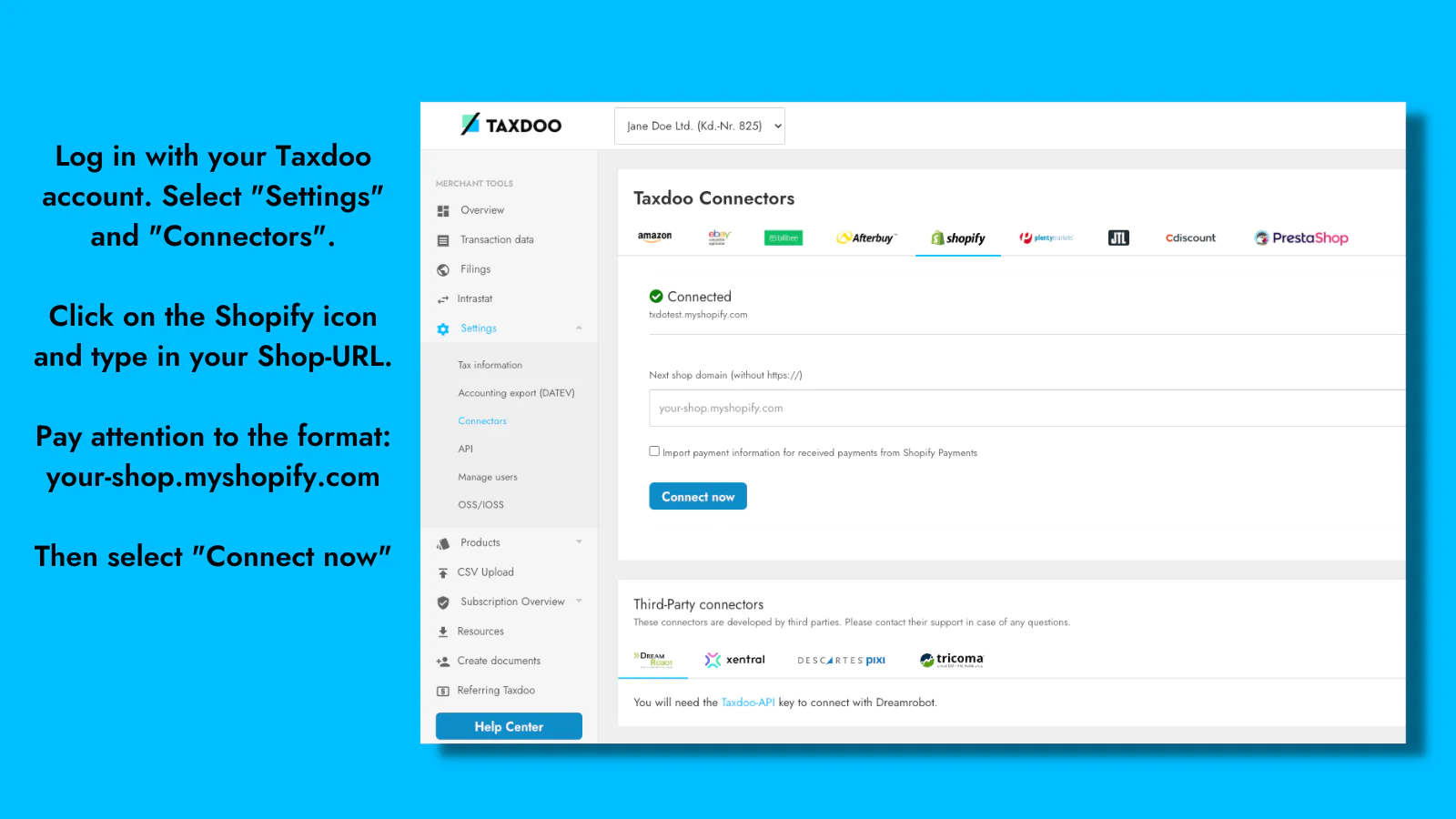

Connect your Shopify store to Taxdoo in just a few clicks and track every sale for tax compliance.

FEATURES

Data Collection

- All your transaction data is automatically synchronised and regularly imported for VAT evaluation purposes.

- No need for manual uploads/coding.

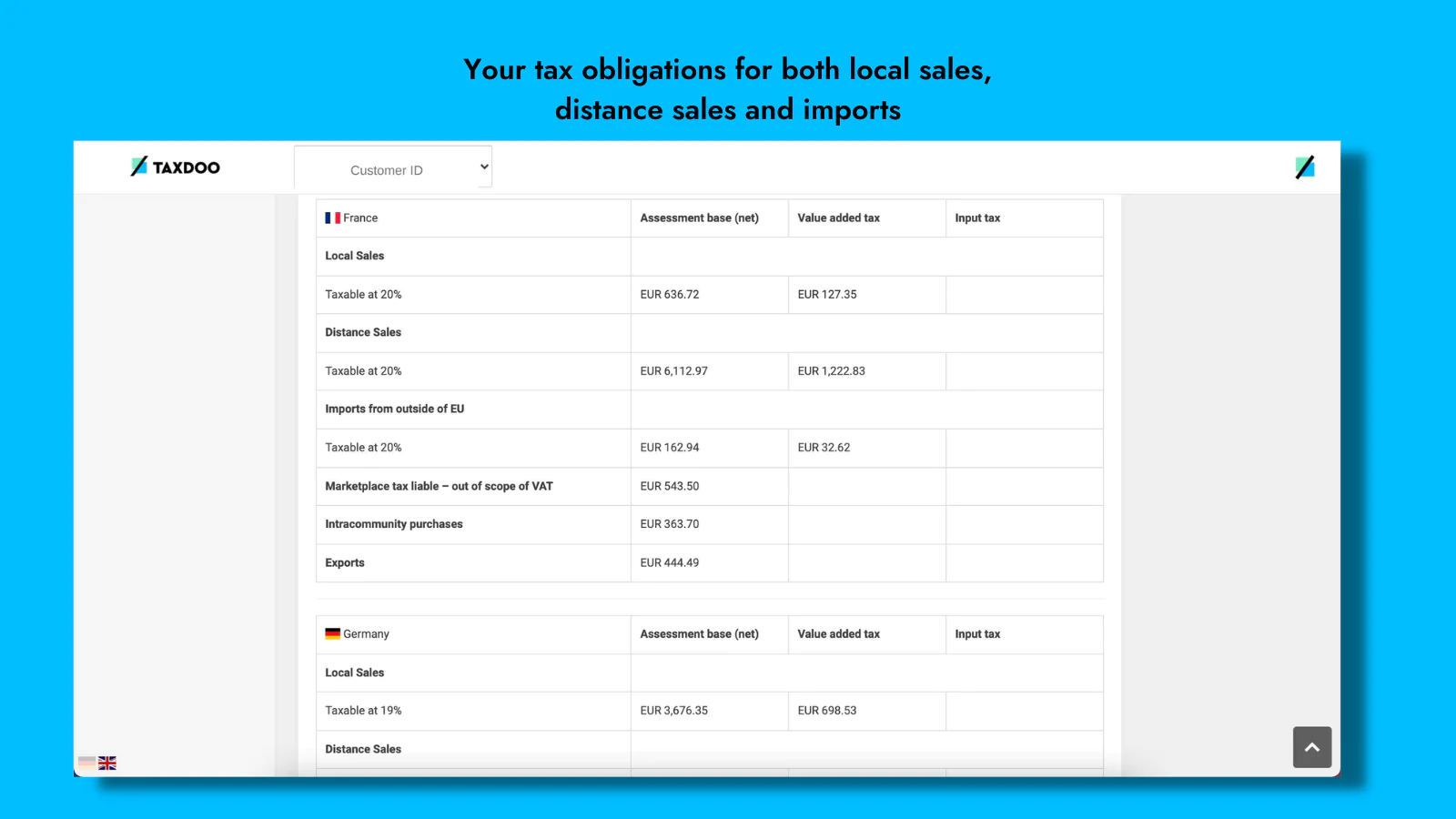

Monitoring and Evaluation

- Every sale, return, and shipment is evaluated for VAT purposes.

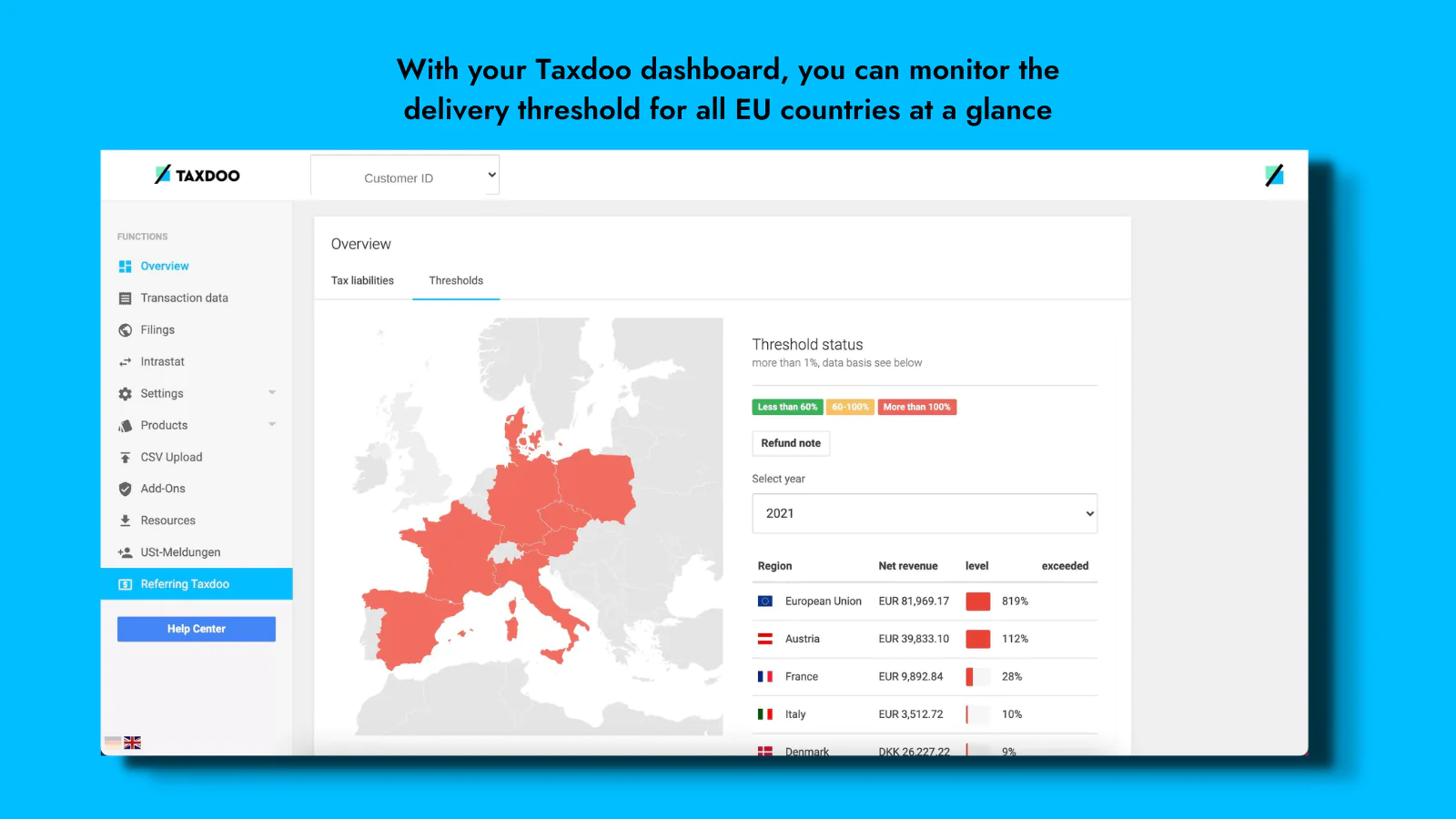

- Taxdoo’s tax engine is updated daily with the latest EU delivery thresholds, tax rates, and exchange rates, and check your corresponding sales data for VAT compliance.

- You have a quick overview of all your EU-wide VAT obligations on your Taxdoo dashboard

- Connect your Shopify payments and other payment providers to have accurate account reconciliation for your tax filings.

Add-ons

On-demand, we can provide you a data export of the following:

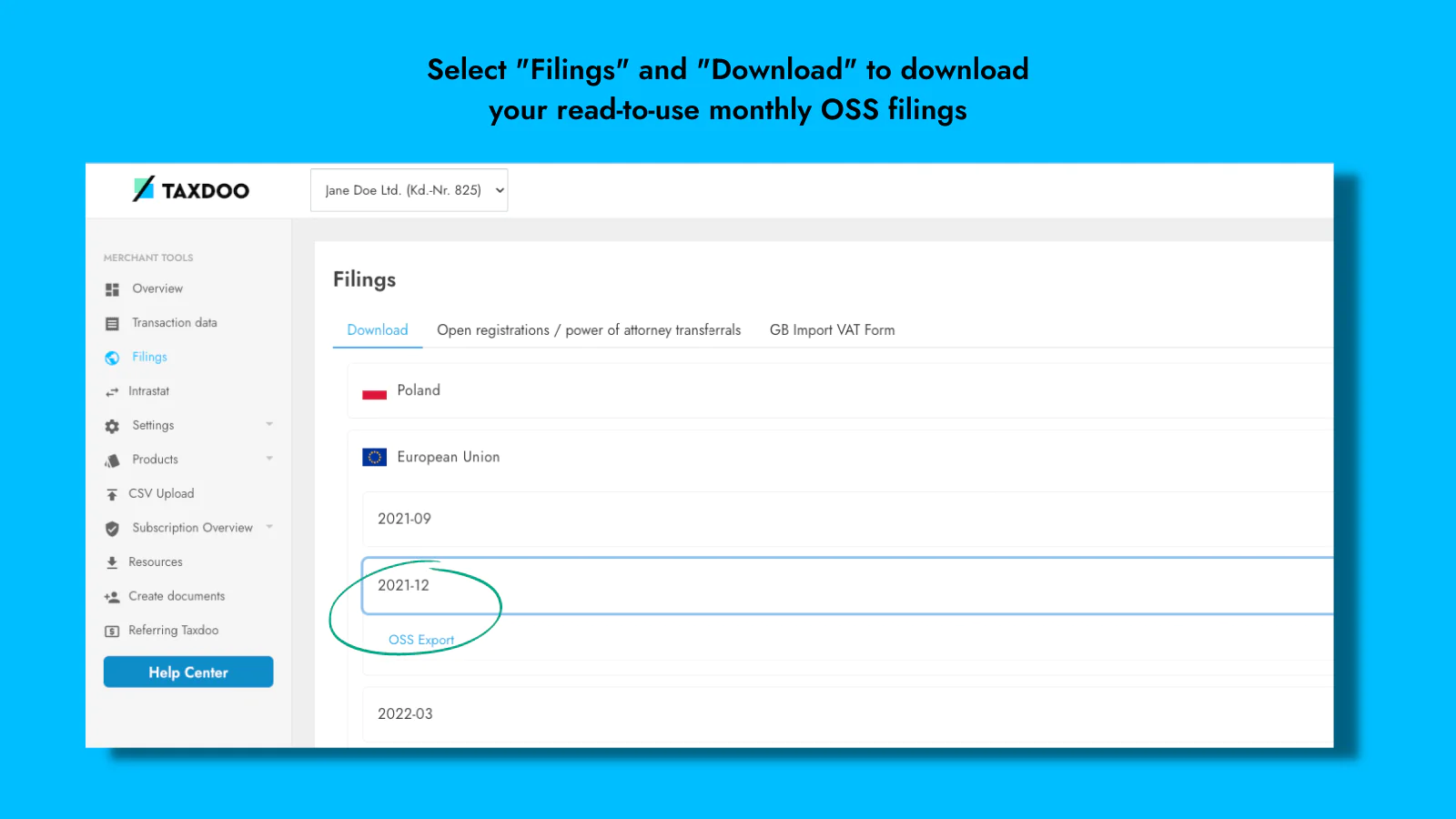

- OSS (One-stop-shop)/IOSS (Import-One-stop-Shop) export for filings

- Intrastat filings

- Pro forma invoices

- Monthly DATEV reports for financial audits and revisions

If you use warehouses in other EU countries, we can also help you with local VAT registrations and filings.

OSS (One-Stop-Shop)

- We automatically determine the different tax rates of each respective EU country.

- We automatically identify your OSS-relevant cross-border B2C sales (distance sales) and provide an OSS export upon request.

- We handle all other VAT registrations and declarations within Europe that cannot be declared via the OSS ensuring that all transactions are reported correctly.

Customer Support

- On registrations, sellers get an onboarding session from our team.

- If necessary, an appointment can be made for DATEV-Onboarding for your tax advisor.

- All sellers can contact the customer support team via E-mail

- In addition, Professional and Premium users have access to telephone support.

- On top of that, Premium users are assigned a dedicated account manager to support them with the setup.

Additional Services from our Partner Tax Advisors

The following services come at special rates and can be arranged on request with our Customer support team.

- Corrective Returns: Fix the mistakes and re-file your tax returns from the past.

- Retrospective Returns: File VAT returns for missed periods in the past

- Communication with Tax Authorities? Our partner tax advisors can take over the conversation for you.

Speed tested: no impact to your online store

About the Author

Matej Kontros is an E-Commerce expert and app developer with over a decade of professional experience in IT.

Matej has worked for organisations of all types and sizes, including global players, startups, and agencies. He designed, developed, and maintained complex projects.

Matej's expertise includes e-commerce, software engineering, web development, systems administration, internet security, managing projects, and building teams.

Visit his website at [ Web Linkedin ] or contact him at [email protected].