Shopify App : Tax Rex ‑ US Sales Tax Reports

Automated US State sales tax return reports for your store

About Tax Rex ‑ US Sales Tax Reports

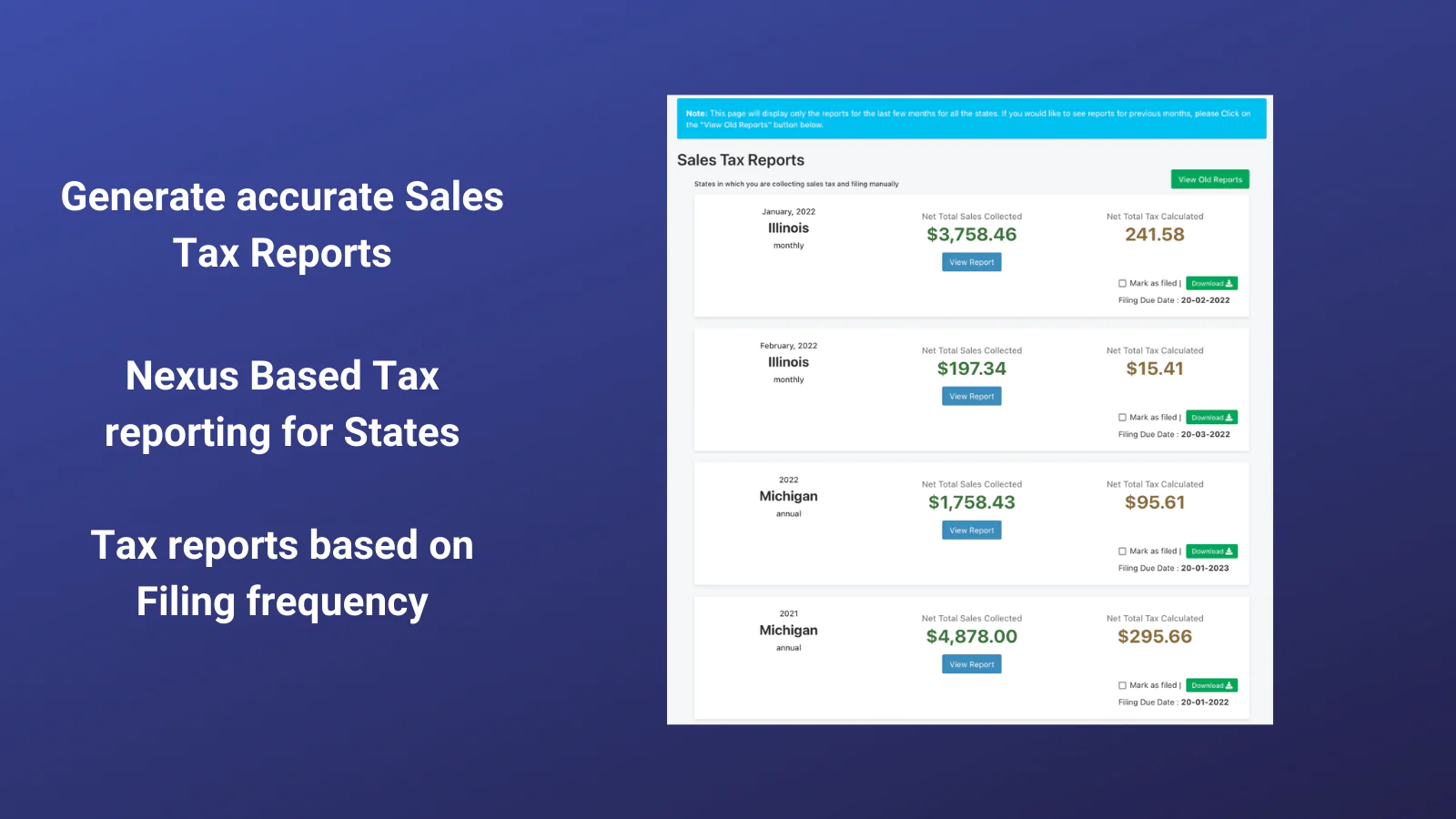

Automated Sales Tax Reporting : Tax Rex generates accurate Sales Tax report in a very user-friendly, ready to file format.

Accurate Tax Reports : The reports are very accurate based on the sales & tax data in Shopify. Returns and refunds are also accounted for perfectly.

Nexus Based Reporting : The generated report has a detailed report based on the jurisdictions in each state that you collect the taxes in.

Tax Rex assists you with creating Tax reports for your USA Based eCommerce stores. It is your reliable partner for Sales Tax reports on Shopify for your sales tax compliance for any state in USA.

Tax Rex makes it very easy for you to generate Sales Tax reports and then file it either yourself or through your Tax advisors/consultants.

Salient Features of Tax Rex

- Generate accurate Sales Tax reports for orders on your store based on your economic and physical nexus laws.

- Sales Tax reports based on jurisdiction for which tax was collected in Shopify

- Simplified tax reports & filing across multiple Shopify stores.

- Timely report generation and filing ability

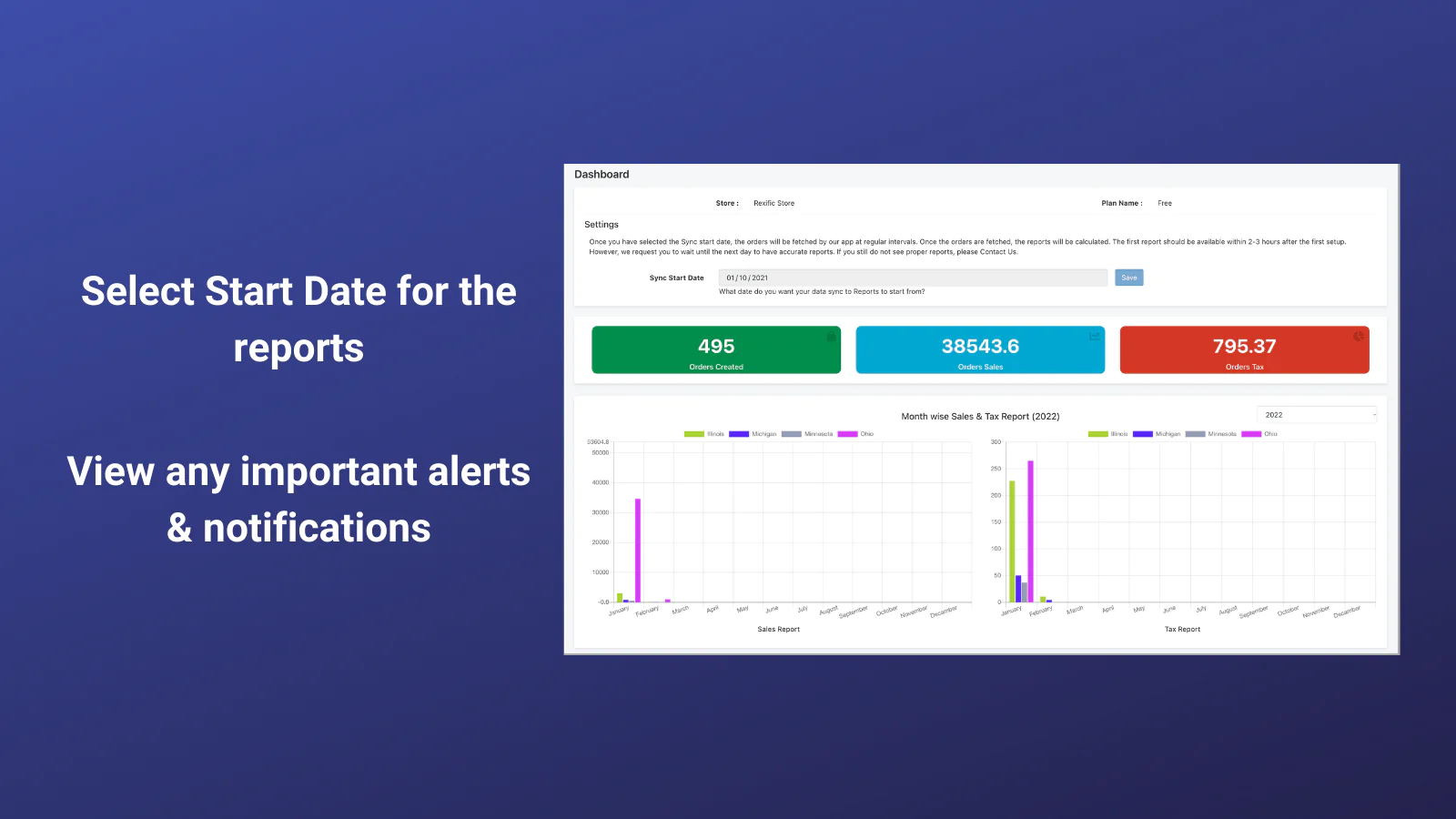

- Select report calculation start date as per your needs

You can add your nexus yourself. If your app finds that you collected sales tax for any other state, we will automatically generate a nexus entry for that state in our app.

Accurate Sales Tax Reporting

Tax Rex will read all your order information and decide how much tax was collected and should be remitted to the relevant state authorities. We generate and provide you with reports that are ready for Filing.

Edit Order

Tax Rex will correctly update the tax collected and total sales figures for any orders that have been edited or refunded from Shopify. An Edit order will be considered as edited on the original order date whereas the refund will be considered on the date of refund/return.

Wholesale / B2B Sales

If the Sales Tax was not collected for any wholesale or B2B sale in your Shopify store/POS, the reports will show the correct tax collected & sales numbers based on the actual sales data in Shopify.

Order Ignore

If you want us to ignore the Sales based on any criteria from appearing in the reports, please let us know and we shall work with you. For eg, you want to ignore Amazon & Ebay orders from Tax Reports.

We report exactly where all you have collected taxes on Sales from your Shopify web store. The reports generated by the app will have a detailed description of the total sales and the tax collected for each of the jurisdictions within the State.

Shopify automatically calculates sales taxes at the time of check out in your Shopify store. Our app will not affect how the taxes are calculated in Shopify. Our app will only generate reports based on the taxes already collected in your Shopify store. Our app will generate Sales Tax reports based on the taxes collected on your Shopify store.

The tax reports are automatically generated every day. However, we also have an option for you to generate the tax reports from within our app.

*** This app currently only works for stores collecting and remitting taxes for any of the States in USA. ***

Seamless workflow: use directly in Shopify admin

Speed tested: no impact to your online store

About the Author

Matej Kontros is an E-Commerce expert and app developer with over a decade of professional experience in IT.

Matej has worked for organisations of all types and sizes, including global players, startups, and agencies. He designed, developed, and maintained complex projects.

Matej's expertise includes e-commerce, software engineering, web development, systems administration, internet security, managing projects, and building teams.

Visit his website at [ Web Linkedin ] or contact him at [email protected].