Shopify App : Order Invoice GST, VAT

Ability to manage GST taxes & HSN codes product wise.

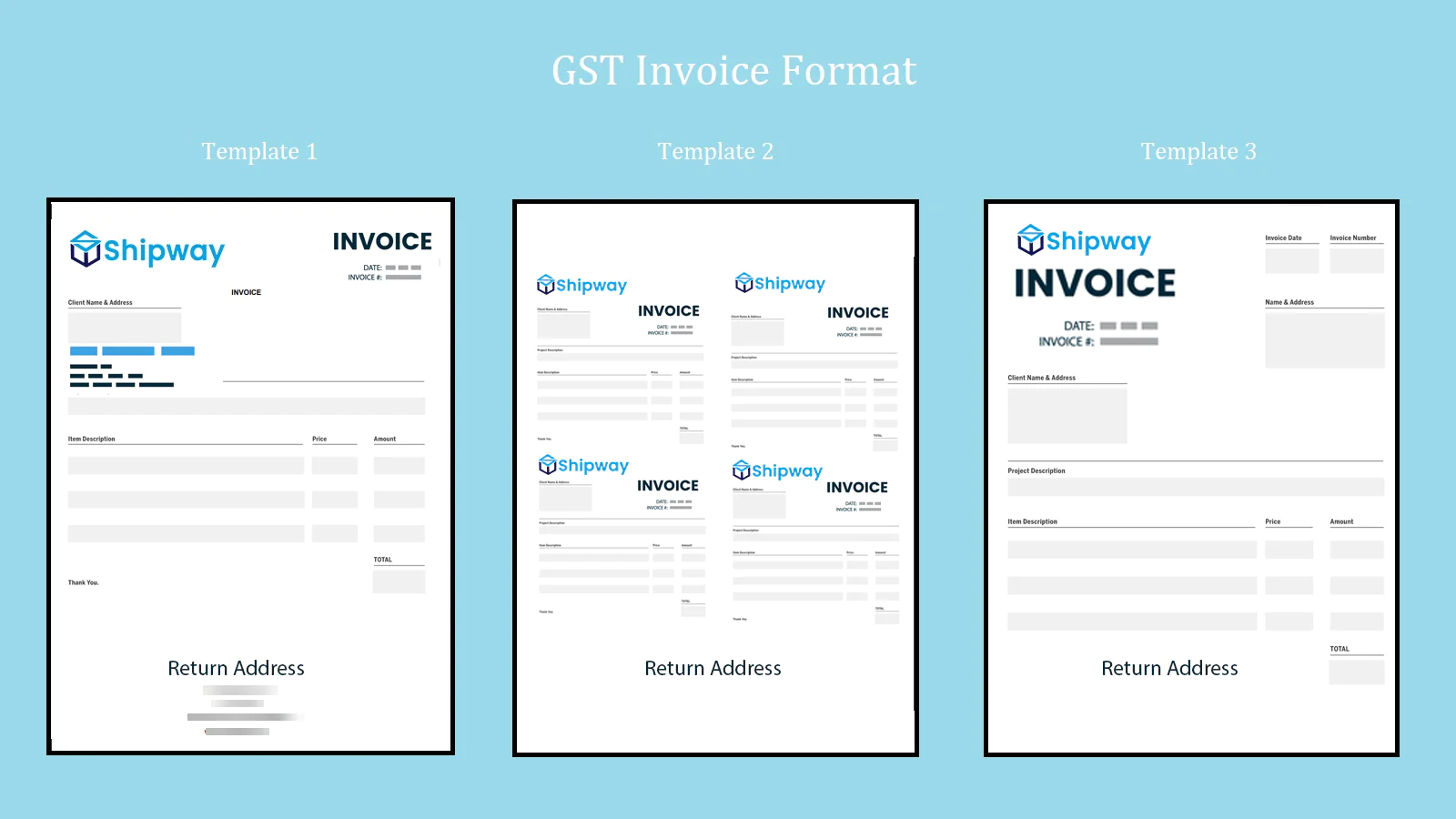

Invoicing Under GST

Under GST invoicing rules and formats have been notified covering details such as supplier’s name, shipping and billing address, HSN Code, GST Tax Calculation.

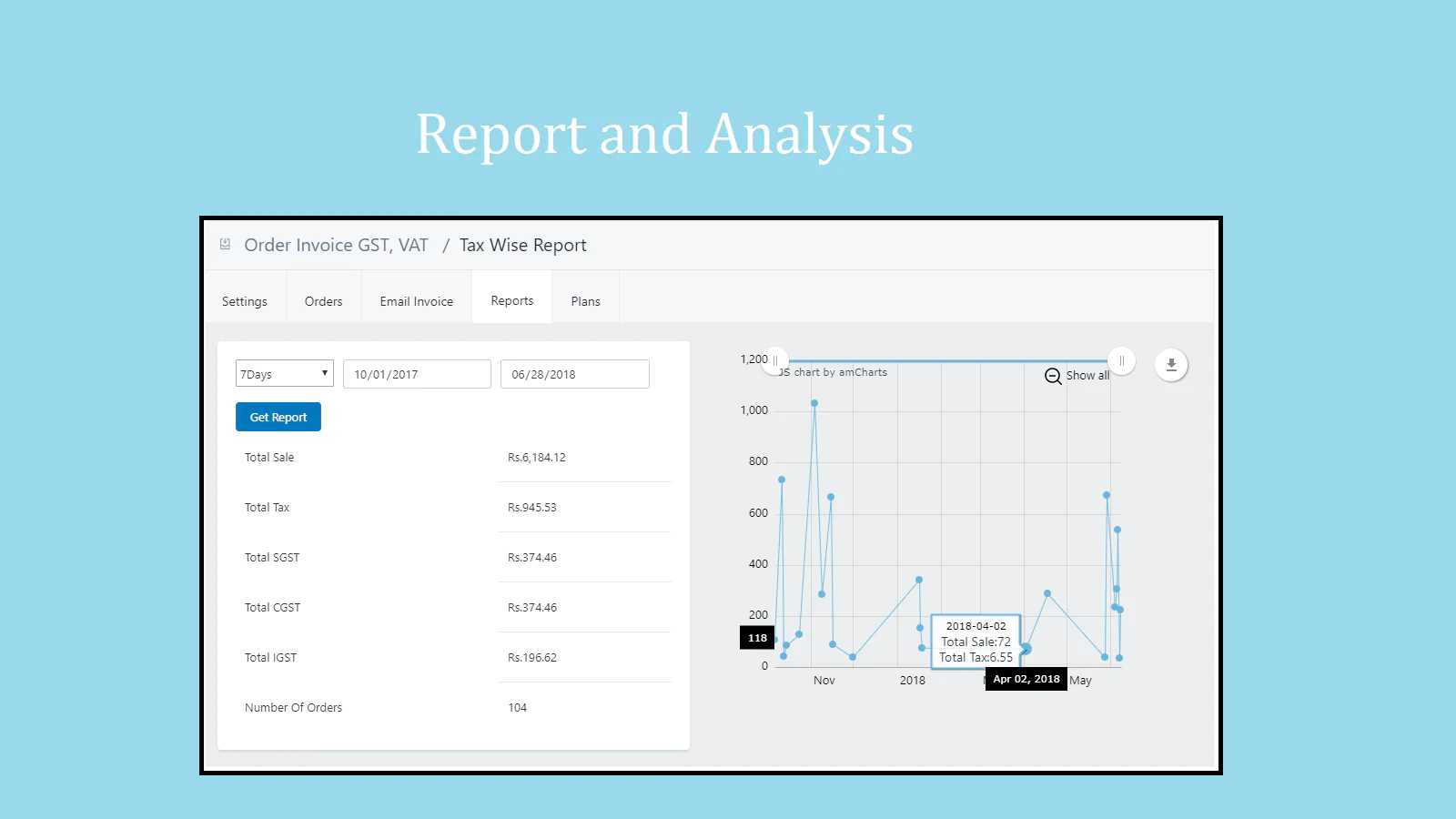

As per the new government norms, GST is applied differently for intra-state and inter-state sales. GST levied on the intra-State sales by the Centre is known as Central GST (CGST) and that by the States is known as State GST (SGST). Whereas for inter-state sales, only IGST (Integrated GST) is applied which is directly paid to Central Government.

Key Features:

- Ability to upload GST Percentage and HSN codes for all the products in bulk.

- Ability to show the state codes on invoices.

- Ability to show the % tag whether its IGST, CGST OR SGST on all invoices.

- Customer can input their GST details on cart page.

- Download weekly/monthly SGST, CGST and IGST tax wise reports.

- HSN/SAC summary reports.

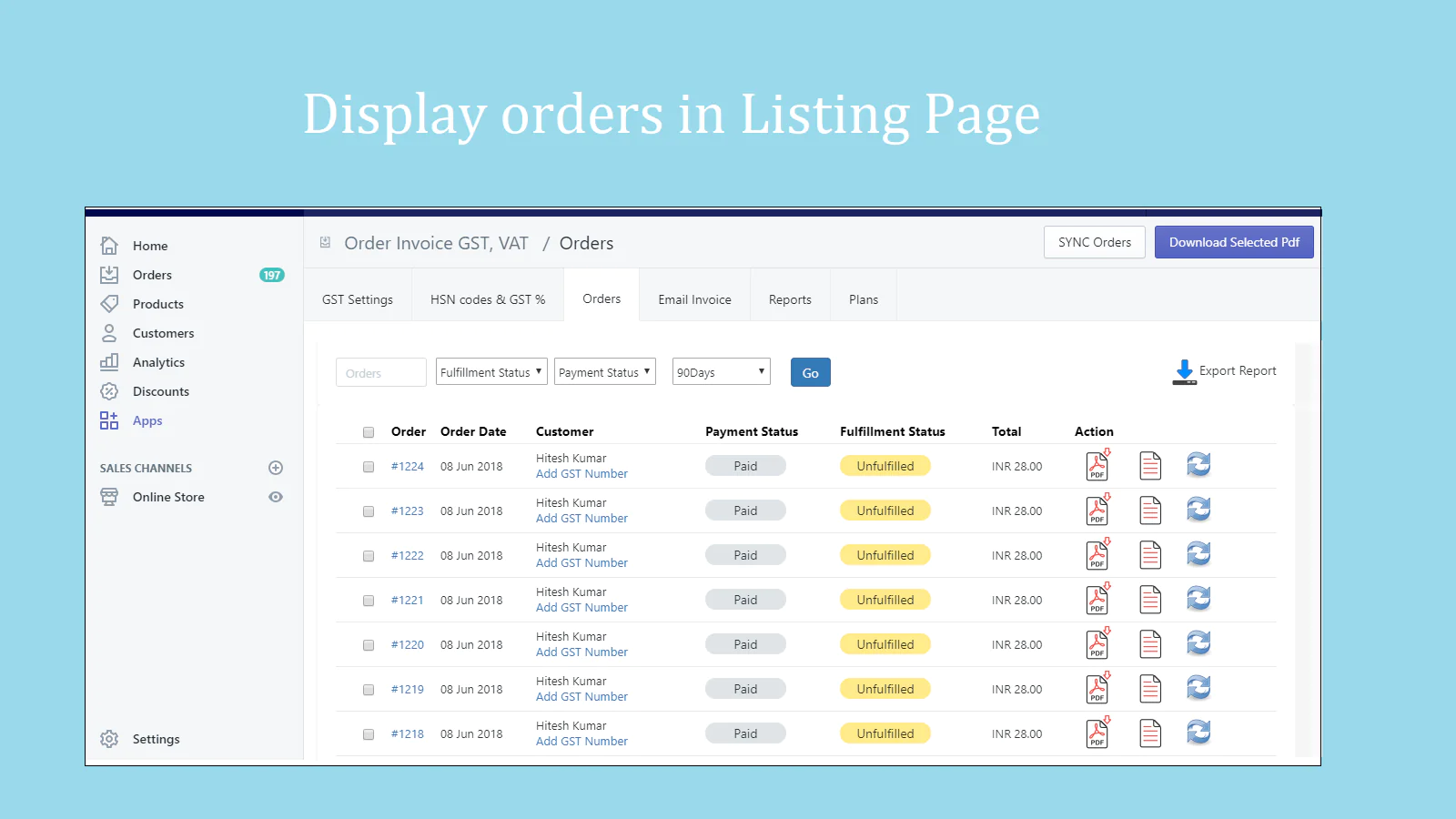

- Filter by fulfillment status, financial status

- Set product prices as including or excluding tax to calculate and display GST.

- SGST, CGST and IGST are automatically calculated and added to order subtotal.

- You can bulk download invoices for any particular order even if the order has been created in the past.

- GST compliant invoices including PDF and emails.

Let's understand this scenario with an example: If your product price is 1100, GST rate is 10%, minimum product price is 2000 and GST rate for the products below minimum set amount is 5%. As the product price is 1100 which is below minimum set price, GST will be calculated considering GST rate as 5% i.e 55.

Set the business origin to auto apply SGST, CGST or IGST based on states of India.

Please note that currently it only support invoices for India, UAE, and Saudi Arabia currency supported is INR

Seamless workflow: use directly in Shopify admin

About the Author

Matej Kontros is an E-Commerce expert and app developer with over a decade of professional experience in IT.

Matej has worked for organisations of all types and sizes, including global players, startups, and agencies. He designed, developed, and maintained complex projects.

Matej's expertise includes e-commerce, software engineering, web development, systems administration, internet security, managing projects, and building teams.

Visit his website at [ Web Linkedin ] or contact him at [email protected].