Shopify App : Malaysia Cash ‑ Oceanpayment

Global Digital Payment Solution Provider

DescriptionOceanpayment, a global payment service provider strives to offer safe, convenient, professional and simple payment solutions to merchants conducting cross-border business. Headquarters in Hong Kong, Oceanpayment comprises a group of experts who have years of working experience and in-depth understanding in payment industry. Operating globally, we have set up Technology & Operation Centers or Business Entity in Shenzhen, Australia, America, Europe and Singapore.

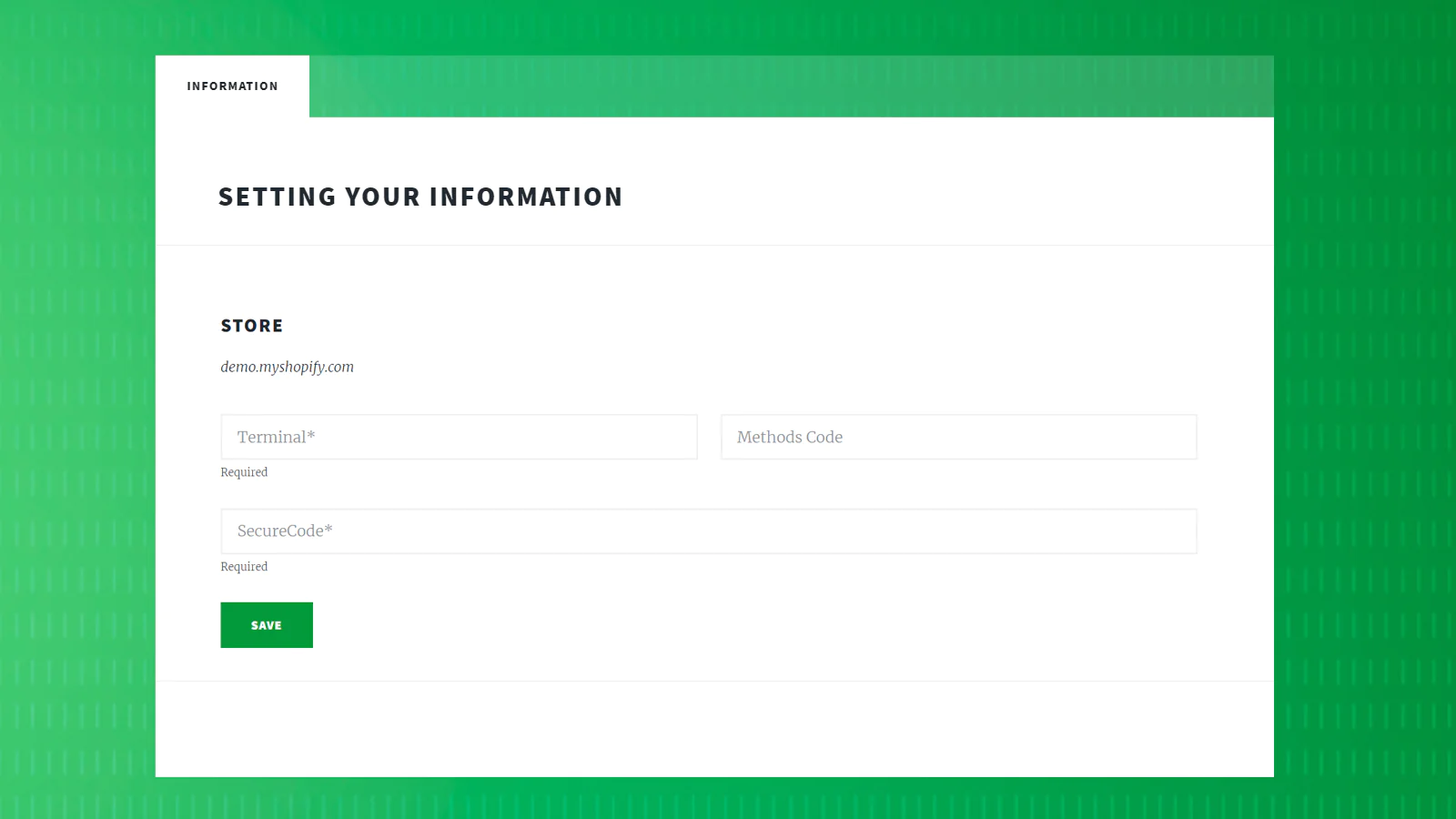

Seamless workflow: use directly in Shopify admin

Revolutionizing Fintech Through Embedded Finance

[2023/04/24 11:01:20]

Digitalization has progressed at a rapid pace and has quickly become part of our everyday lives. The fintech revolution is one of the most eminent examples of digital transformation, with various new concepts and products materializing every day. One such concept that is going strong and gaining immense popularity is embedded finance, where conventional businesses are integrating financial mechanisms into their overall business plan. This novel collaboration between technology providers, financial product distributors, and banks utilizing non-financial platforms is being dubbed the embedded finance revolution. With $20 billion in revenues in the United States alone for the year 2021, according to a report by McKinsey, this article will shed more light on the consistently increasing popularity of embedded finance and why it is being hailed as the future of finance.

Freestyle Living! Digital Wallet Trailblazers Generate New Opportunities for Merchants

[2023/04/17 06:16:02]

Use the mobile phone to place an order for a coffee to start the day. Swipe the QR code to commute to work. Order a takeout lunch with the mobile phone. Go online shopping for bargains and place orders. Flash sale! Book tickets for that coveted vacation. …… Since the launch of the first ‘Global Cashless Day’ on August 8 2015, many have adopted and embraced this new way of living, and the scenarios of a daily routine described above have become commonplace. With the development of digital payment across the globe, a mobile phone is all that is necessary for an individual to organize their day, from meals to transportation to entertainment. According to a SkyQuest report, the changing habits of the consumer have increased the number of digital wallet users from under 200 million in 2016 to a whopping 2.8 billion in 2020, with an estimated 74% of the world’s population adopting the mobile wallet by 2028.

How to select the best Credit Card Processing Solution

[2023/04/10 04:14:07]

This article dives into processing credit card payments online by businesses, and the factors that should be taken into account when choosing the right credit card payment provider, as well as the risks associated with processing credit card payments online. What is credit card payment? With a credit card, your purchase amount is added to the balance of your account, which is typically called the balance of your credit card. In addition to your purchases, your balance also includes any discounts you’ve earned. Your balance includes interest and any fees and penalties you have been charged by the card issuer. In addition to annual fees and foreign transaction fees, there may also be cash advance fees and late payment penalties. During each monthly billing cycle, your card issuer will tell you how much you owe, how much you must pay, and when you must pay. You will remain in good standing with your credit issuer if you make at least the minimum payment on time.

Your best WooCommerce Payment Gateway Solution

[2023/04/10 03:55:21]

In this article, we explain what a WooCommerce Payment Gateway is and how it can help businesses ensure a seamless customer experience during the payment process. We also highlight some of the factors businesses should consider when selecting WooCommerce payment gateways. What is a Woocommerce payment gateway? A payment gateway for Woocommerce is a WordPress plugin that adds payment functionality to an online store. It is here that the customer enters their payment information (credit and debit card numbers, bank details, PayPal credentials, etc.) This is where the cashier process takes place. For some stores, the buyer is redirected to an external site for payment; for others, they are allowed to pay directly on your site. Payment gateways require sellers to open merchant accounts with the providers before they can use them. Once activated and installed, a payment gateway can be used immediately. Payment Gateways operate successfully when four parties are involved.

Subscription-based Ecommerce – Breaking New Grounds

[2023/03/23 08:14:02]

As the competition for cross-border ecommerce revenue heats up, service providers have come up with offerings galore to entice and retain consumers. One product that has caught the attention of the Millenials and GenZ consumers overseas is “subscription-based consumerism”. With rapid urbanization, infrastructural development and the ready availability of more efficient and faster internet connectivity, the younger cohorts of consumers, armed with enhanced purchasing power, have become increasingly dependent on the internet, embracing it as an integral part of the lifestyle. This behavior has, in turn, spurred the proliferation of subscription-based consumerism. The latest RM2023 report highlighted that, in 2022, subscription-based consumerism was estimated to be worth about USD96.61 billion globally and, with a projected growth rate of 71% in the next 5 years, this amount is expected to reach USD24.2 trillion by 2028.

What is 3DS2.0 and how does it work?

[2023/01/31 03:46:17]

Since October 2022, the major credit/debit card associations have gradually stopped supporting or offering 3DS1.0 services. Instead, they have been strongly advocating the use of Strong Customer Authentication (SCA), a protocol that enhances security for the online consumer and, at the same time, minimizes the merchant’s exposure to fraud risks. In line with the UK’s implementation of SCA commencing 3rd April 2022, the European Economic Area (EEA) has also launched this protocol to enhance the security of customer-initiated online payments and contactless offline payments and minimize fraud risk for the merchant. How do you ensure the security and efficient operation of your business in Europe and reap the benefits of the shopping frenzy? The answer is a full-scale adoption of SCA. Are you required to comply with PSD2-SCA? According to the PSD2, consumers transacting online within the EEA must comply with the SCA conditions stipulated by the payment acquirers within the region.

Getting Off to a Good Start for 2023! Oceanpayment is now a Major Payment Institution in Singapore

[2023/01/17 11:47:14]

On the 1st business day of 2023, Oceanpayment received the excellent news that we had been awarded the Major Payment Institution (MPI) license by the MAS (Monetary Authority of Singapore), a key milestone in our strategic quest to grow and develop a sustainable international market. Effective on 1st January 2023, this license enables us to operate domestic and cross-border funds transfers, merchant acquisitions and a host of other related services. Under the Payment Service Act which was launched on 28th January 2020, financial service providers can apply for one of the 3 types of licenses issued by the MAS – the Money Changing license (MC), the Standard Payment Institution license (SPI) or the Major Payment Institution (MPI) license.

What Is Card Acquiring? – Global and Local Payment Processing

[2022/12/30 02:56:14]

You must be familiar with online payments and credit and debit card transactions if you’re a business owner. When you expand your business globally, payment is one of the most crucial buying process steps. Convenient payment methods do not only enhance customer experience but also help expand your business in international markets. This is why an acquiring business establishes networks with banks or licensed payment processing companies to acquire an account that processes transactions. But becoming a credit card acquirer is an extremely complex process that requires many technical system integrations, merchant contracts, and certifications before you get to process your transactions. Since the process is complex, a merchant acquirer bank fails to offer the full range of available global payment methods.

How Does Online Payment Work? – An Insight into the Mechanism

[2022/12/30 12:00:52]

With the increase in online shopping, businesses are increasingly looking towards the internet to expand their customer base and get more sales. To successfully expand into a wider market, it is essential for businesses to accept online payments. These payments are managed online as a result of the interaction between multiple involved stakeholders to facilitate the payment process for the banking company. Understanding the working mechanism of online payments is essential to adapt to this digital era and shift towards a modern payment processing process. How Online Payments Work – The Process Before getting started with how online payment works, it is essential to have further context on the core stakeholders that are involved in online payment processing. When it comes to processing online payments, whether that is through eCommerce, physical POS, or other methods, the primary stakeholders in the process are the customer, the middle technology, and the business.

Seamless Transactions! Understanding Payment Acquiring Process

[2022/12/19 10:28:41]

“Payment for Purchase – The Complete Transaction” “Cash & Carry” – the simplest mode of any transaction. Be it on or off-line, physical goods or service related, what matters most to the consumer is that their purchase is successfully and satisfactorily fulfilled. To the merchant, receiving the transacted funds securely from the consumer is of highest priority. Payment Acquiring: Process the payment for the transaction efficiently and in a secured manner, ensuring that the merchant receives the transacted amount without issue. Payment Acquiring Bank: Also known as the merchant acceptance bank, this is the primary funds transfer link between the merchant and the consumer. It is the respective acquirer, one of many that partner with the merchant to enable payment transfers made via different acquirers. A cross-border transaction includes a specific process of detailed verification and validation.

About the Author

Matej Kontros is an E-Commerce expert and app developer with over a decade of professional experience in IT.

Matej has worked for organisations of all types and sizes, including global players, startups, and agencies. He designed, developed, and maintained complex projects.

Matej's expertise includes e-commerce, software engineering, web development, systems administration, internet security, managing projects, and building teams.

Visit his website at [ Web Linkedin ] or contact him at [email protected].