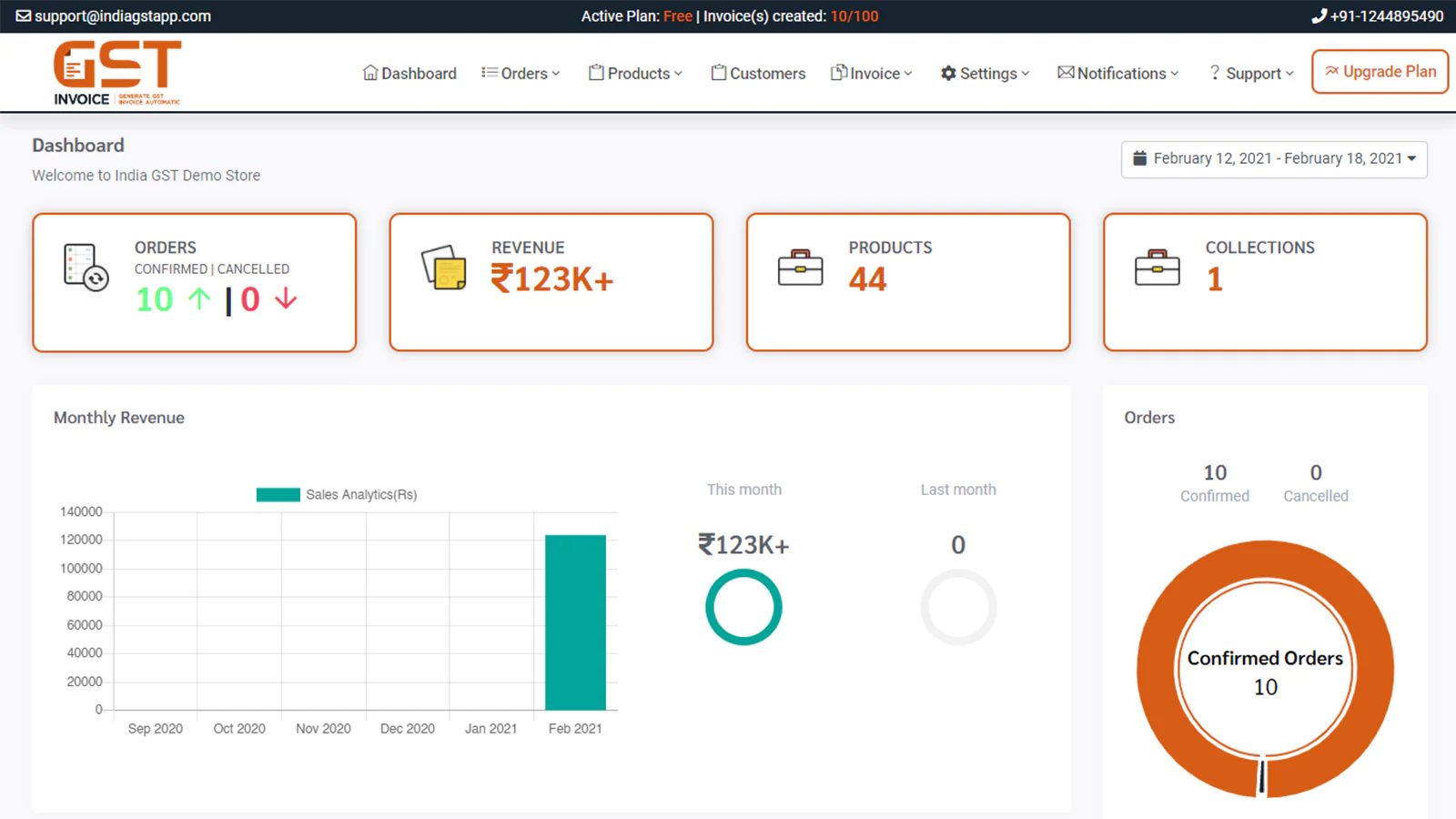

Shopify App : India GST App

GST Invoice per individual Product, Download GST invoice, POS

About India GST App

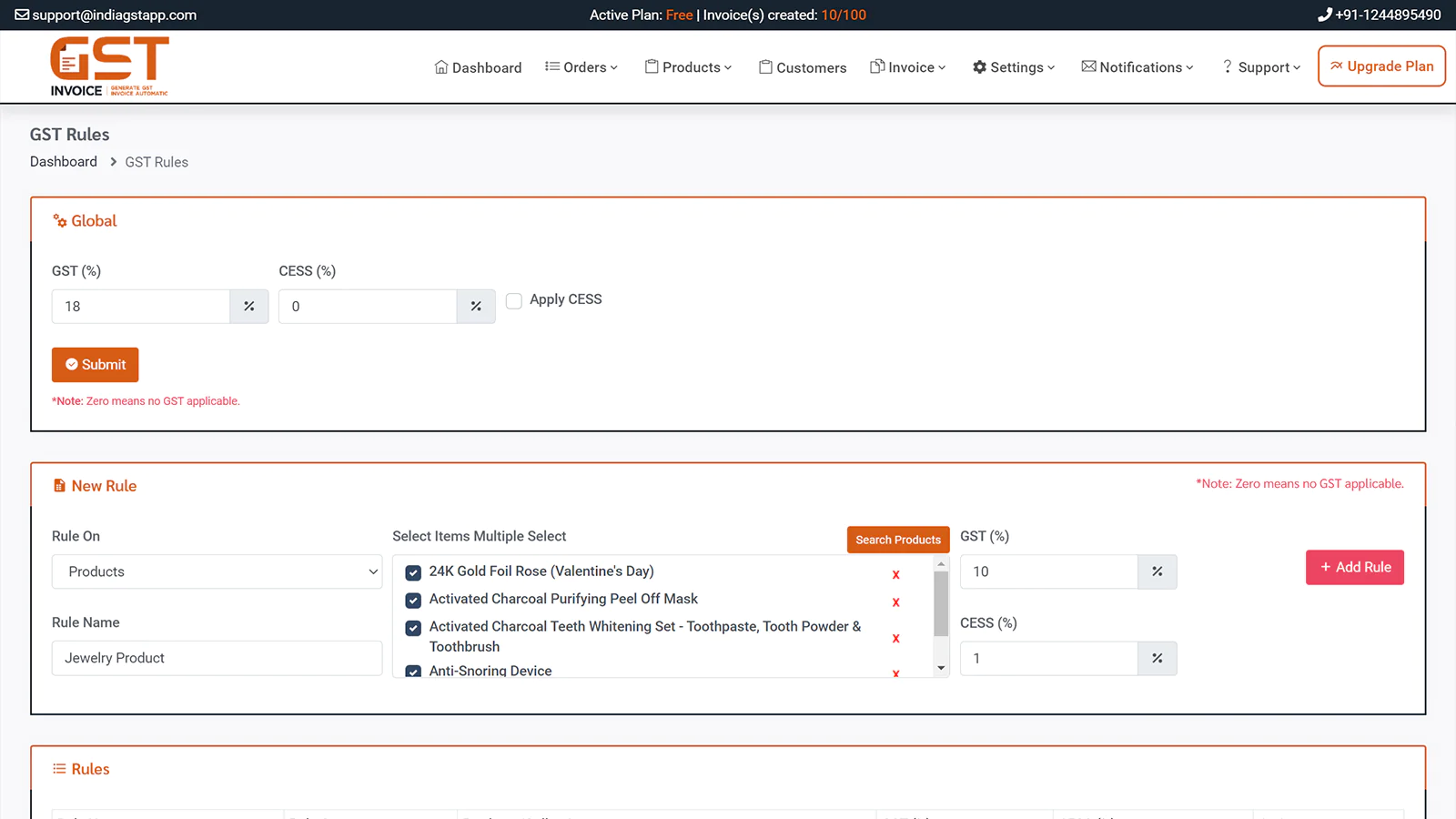

Global Rules : Ace your business game. Easily set your GST rates for individual products / collection using our customized dashboard.

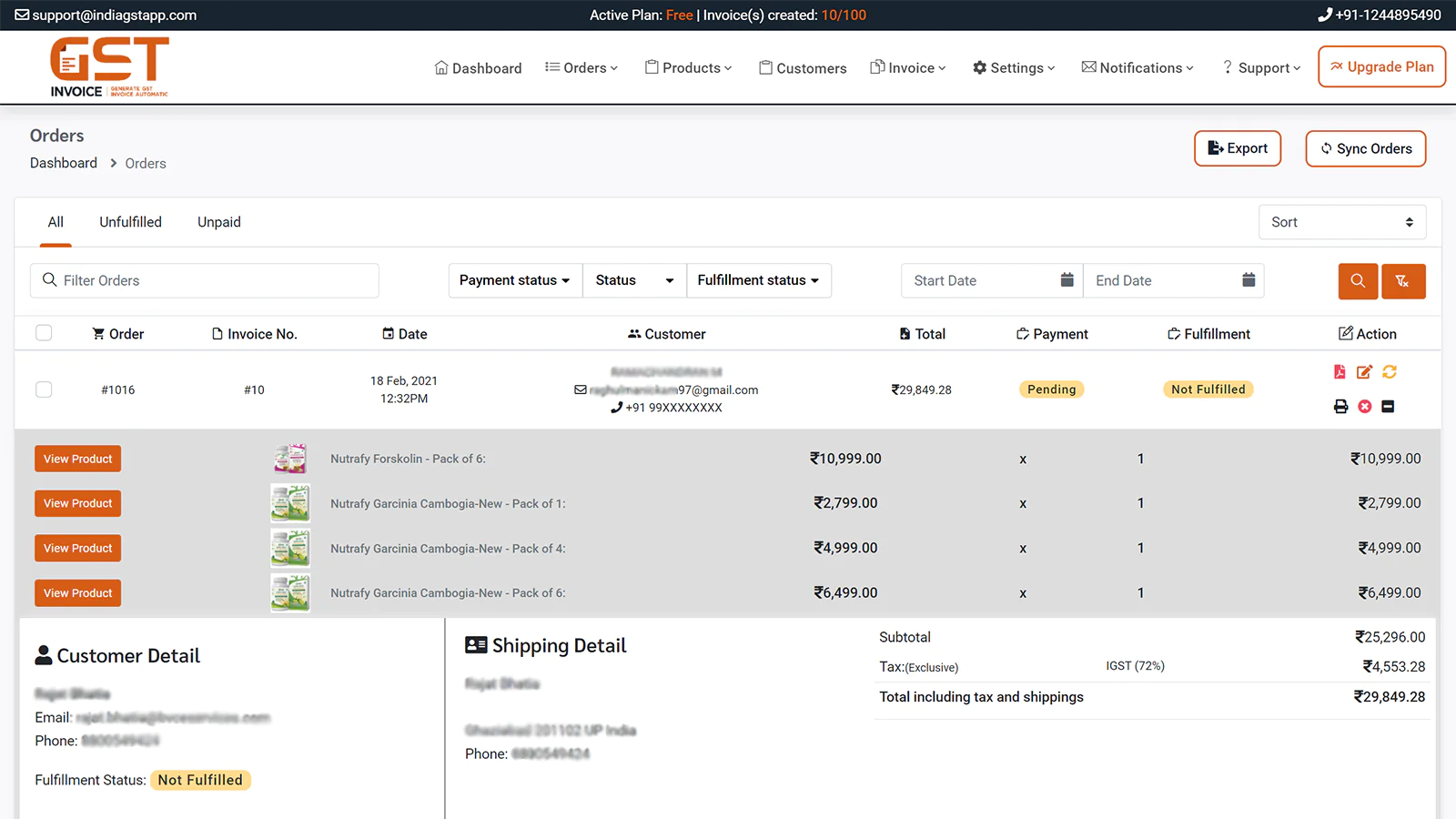

GST Ready/Order Invoice : Calculate and generate GST ready invoices automatically. Apart from GST, you can also calculate state-wise IGST, CGST, and SGST.

Import/Export Order Invoice : Easily upload, import, and export invoices in bulk according to your business needs and requirements.

About GST Invoice India

Generate Invoice with GST details

Easily generate GST invoices without importing your order data into third-party software with the GST app. The app fetches order data in a hassle-free manner generating GST compliant invoices.

Product HSN Code

Now, you don’t need to add HSN codes manually in this app. Our app will auto-sync HSN code from your Shopify store if added there.

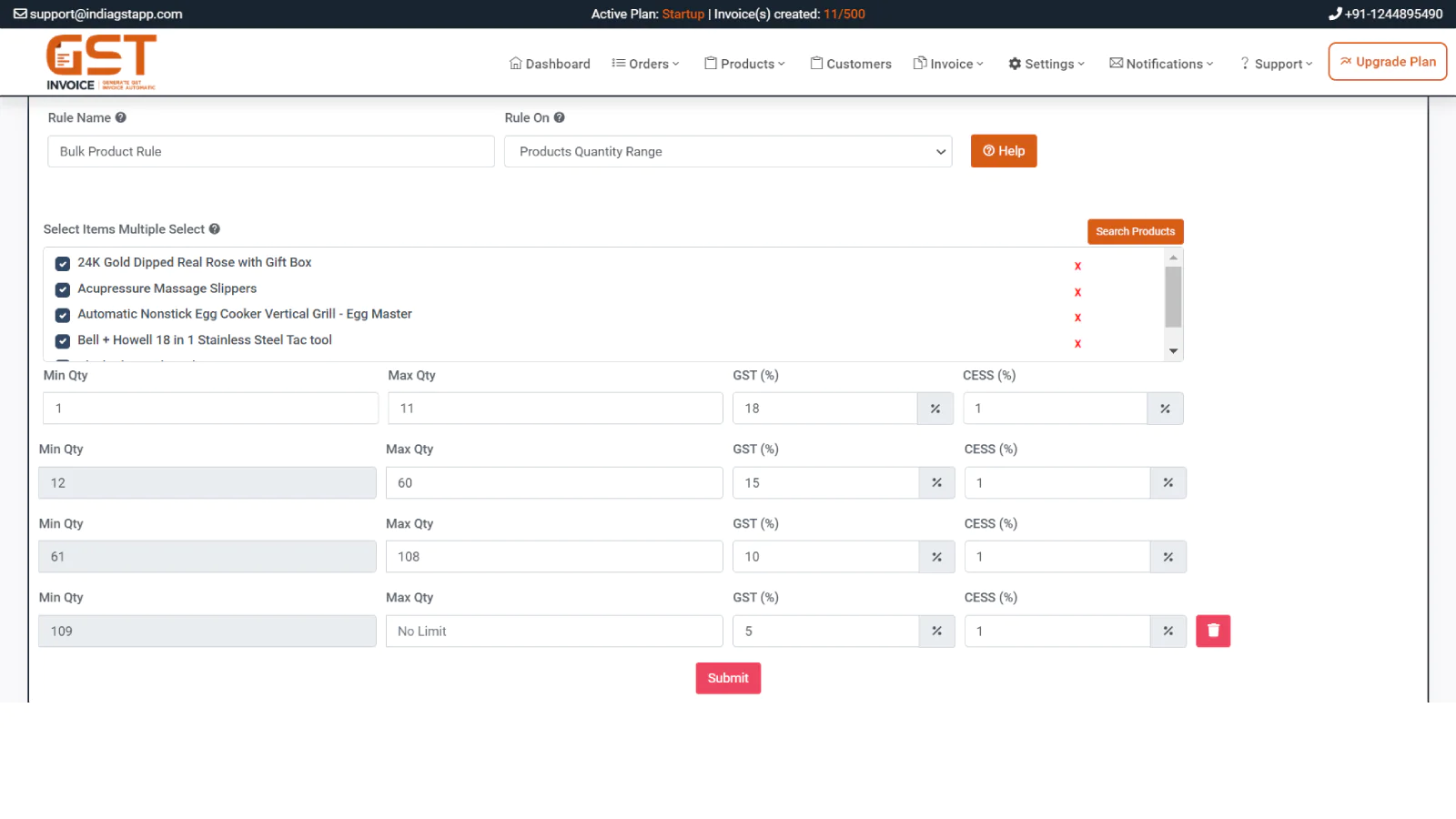

GST Settings by Product / Collection / Order Value

With this feature in place, now you can effortlessly set Product GST percentages for your GST invoice tax calculation without any hassle. It lets you select different ranges of product quantity, sale price, or order value and this app will calculate the GST amount accordingly. This further gives you broader flexibility while covering more ground to calculate your GST on different segments of products & services. The rules are based on the following options:

- Products / Collections

- Products Sale Price Range

- Products Quantity Range

- Order Value Range

GST on Shipping

The GST app provides you with on/off GST settings on the shipping charges as per your particular needs. Also, you can easily set Shipping GST percentages which are further used as an important element in GST tax calculation.

CESS Settings

You can set CESS percentage separately in this app and it will also allow you to specify CESS for different states.

Download Invoice

According to the Indian Govt. Rules, you will be able to generate three kinds of invoices.

- Original Invoice for Buyer

- Duplicate Invoice for Transporter

- Triplicate Invoice for Supplier

Auto Email Invoice

It’s also possible to send automated customer emails using which the customers now will be able to download their invoice using just an email link.

Auto Order Sync

What’s great now is that you will not need to sync your orders. This app syncs orders with ease and generates the three main types of invoices using PDF format.

Invoice History

Maintain your order related history inclusive of GST rating and product pricing without any kind of glitch. This enables you to download any past dated invoices as well.

GST Collection Report

Generate a collection report with ease using a date range filter configured within the app. It allows you an enhanced functionality to download the CSV file with all order data along with the entire collected GST amounts. The report that you will get will be inclusive of CGST, SGST, along with the IGST as per the store orders. You can also file GSTR-3B, and GSTR-1 returns using this report.

Multi-Location fulfillment support

If you want to calculate GST based on fulfillment location then, the GST app allows you to calculate GST based on your fulfilled inventory location too.

About the Author

Matej Kontros is an E-Commerce expert and app developer with over a decade of professional experience in IT.

Matej has worked for organisations of all types and sizes, including global players, startups, and agencies. He designed, developed, and maintained complex projects.

Matej's expertise includes e-commerce, software engineering, web development, systems administration, internet security, managing projects, and building teams.

Visit his website at [ Web Linkedin ] or contact him at [email protected].