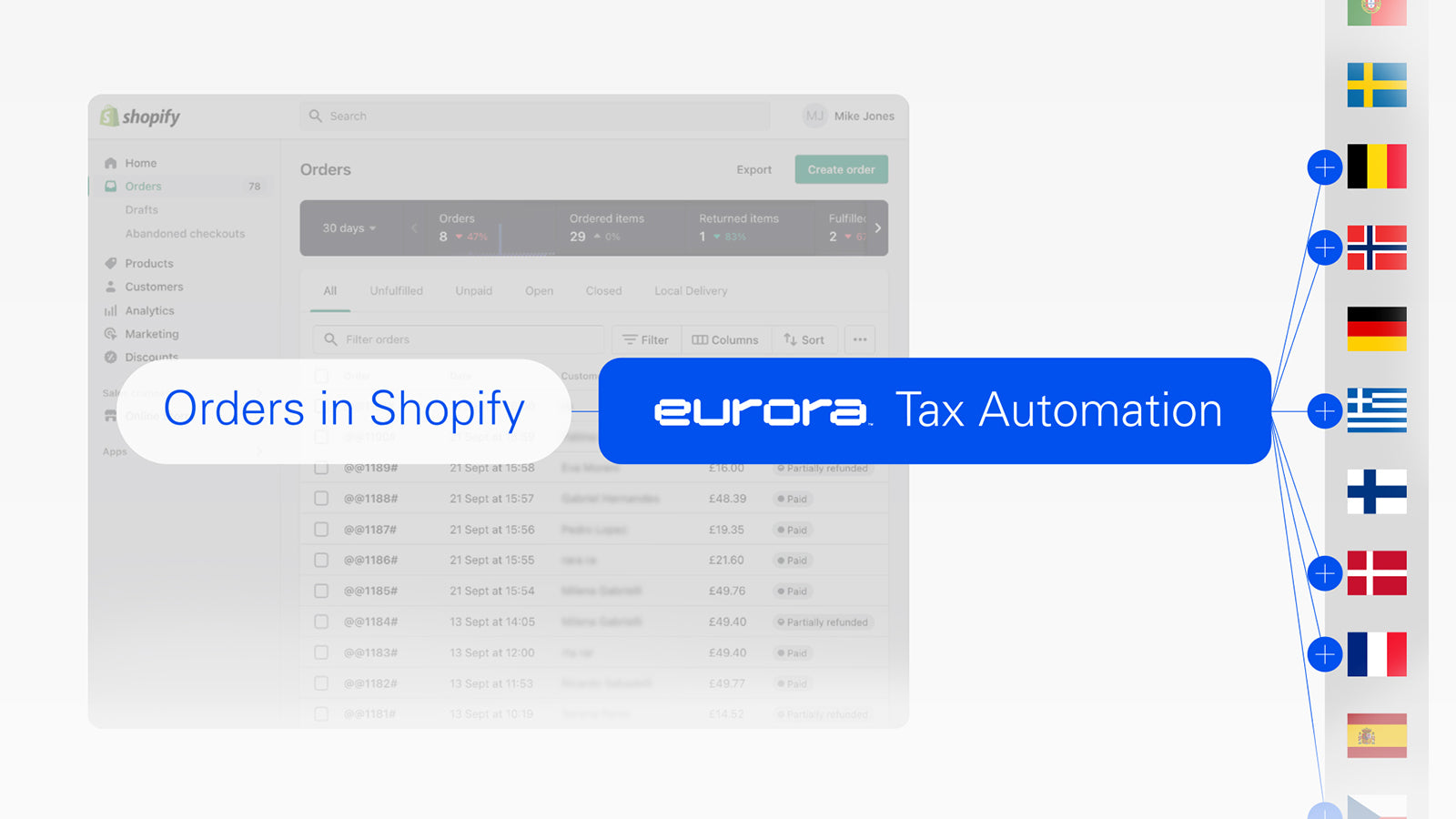

Shopify App : Eurora Tax Automation

Save time managing EU taxes (IOSS)

About Eurora Tax Automation

Reach the whole EU market : Easily sell to every EU country in full compliance with EU VAT regulations. We submit all your monthly VAT returns in a timely manner.

Automate your tax compliance : Benefit from effortless processing and reporting. Your IOSS sales data is automatically processed and transferred to tax authorities.

Boost your customer experience : Ensure full cost transparency and faster delivery to your customers. No extra fees await them at delivery as they pay all taxes upfront.

Eurora Tax Automation:

Selling to the EU does not have to be hard. Eurora Tax Automation offers merchants the easiest and most secure way to sell to EU customers using the IOSS scheme. Add Eurora Tax Automation app to your store to unlock the whole EU market in full compliance.

App features:

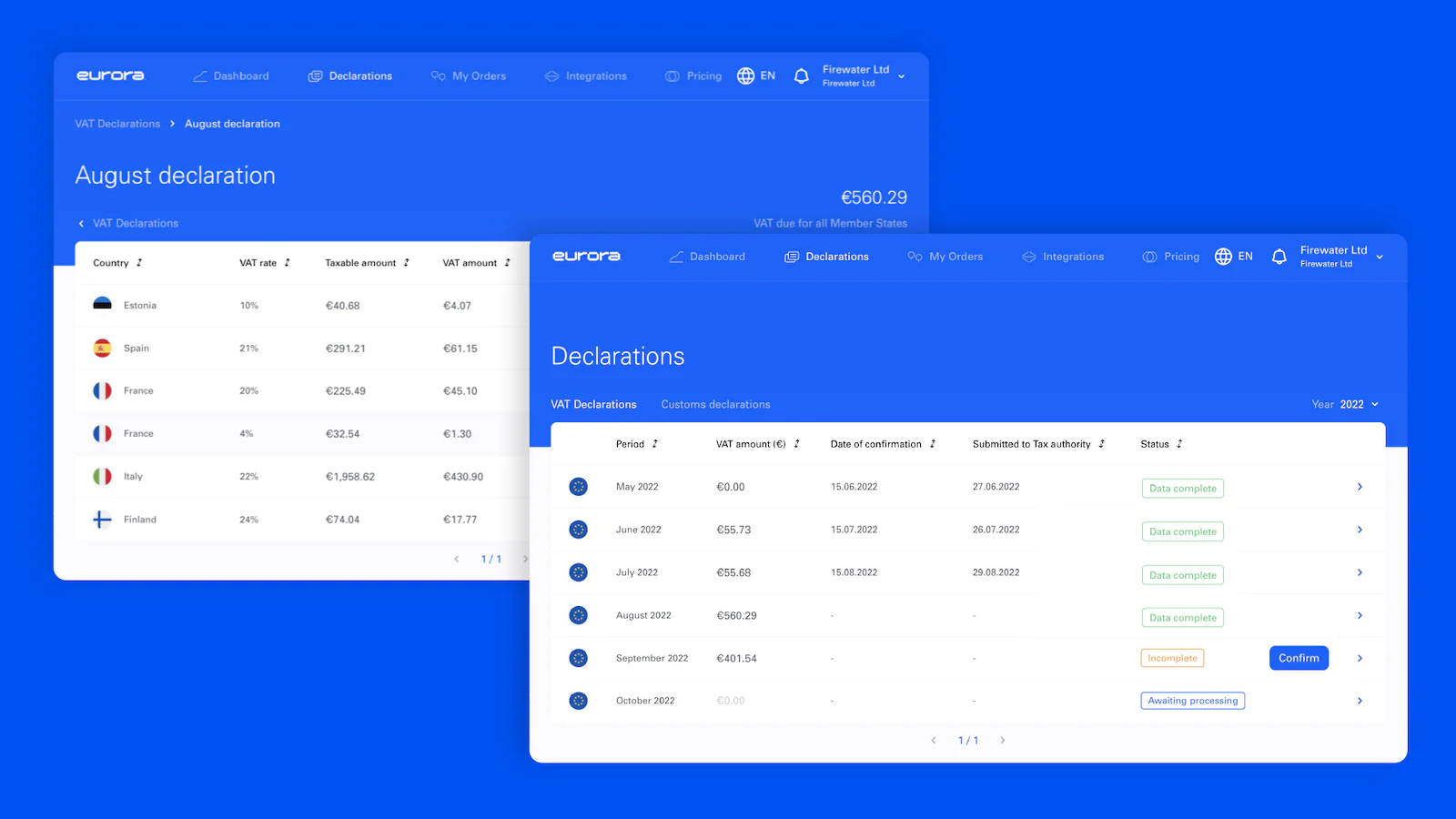

- Real-time IOSS order processing

- Automatic collection & payment of EU VAT

- Always up-to-date EU VAT rates & regulations

- Secure order data handling

Key benefits:

- Reach the whole EU market

- Automate your tax compliance

- Delight your customers

- Reduce your operation costs

You can use Eurora Tax Automation with the IOSS scheme if:

- You are a B2C seller

- Your goods are located outside the EU when they are sold

- The goods you are dispatching have a value inferior to €150

FAQ:

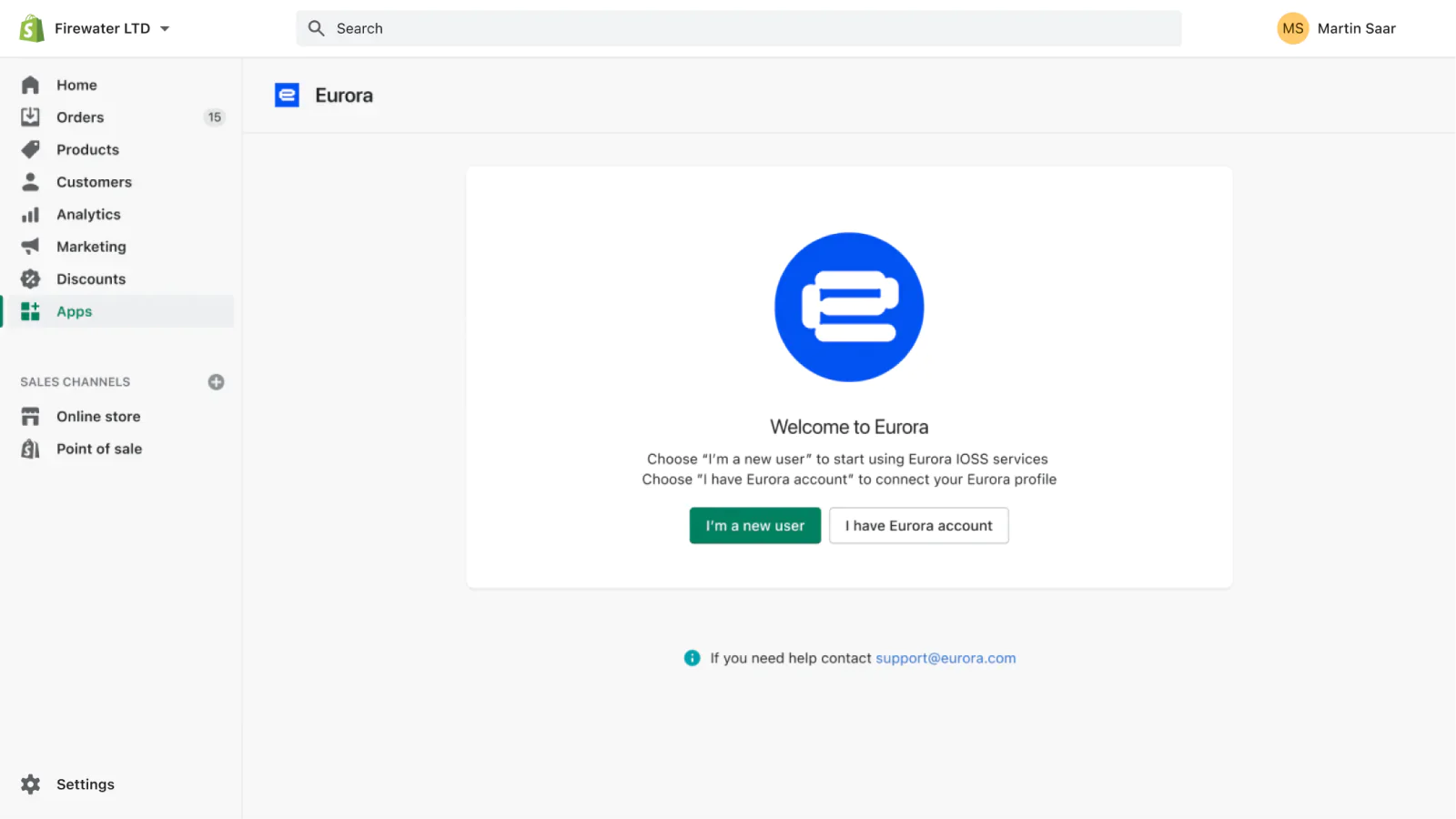

What do I need to do before installing the app? Before installing the app, please make sure that you: 1.Activated "VAT on sales to the EU" by clicking “Collect VAT” in the Stores "Taxes and Duties" settings. 2.Entered the IOSS number received from your personal Tax consultant at Eurora.

Can I use the Eurora app if I have IOSS number issued by another Intermediary? Unfortunately, no. Every Intermediary is responsible for their customers’ sales data and VAT returns. Eurora can`t represent other Intermediary customers. To use the Eurora app you must sign-up with Eurora.

How much does the Eurora app cost? The app’s one-time price is 4.90$ and you'll directly be invoiced for the IOSS service package. Applicable charges (i.e. IOSS submission, VAT data verification, VAT payment transfer, use of Eurora Service Portal, representation before Tax Authorities) will be invoiced in accordance with the Eurora plan chosen and considering monthly IOSS orders volumes. The monthly package starts from €49 and already includes 25 IOSS orders. We will invoice €0.25 per each extra IOSS order if your sales volumes grow to 25+ orders monthly.

Do I need to do anything before or after uninstalling the app? No special actions are needed. Just continue running your business as usually.

About Eurora:

Eurora is an AI backed cross-border e-commerce compliance platform focusing on automating global trade. Our mission is to automate every aspect of the cross-border supply chain by reducing the amount of manual labor and the time spent on compliance. All to help eCommerce sellers move their goods faster, reduce their resource costs, and improve their customers satisfaction.

Seamless workflow: use directly in Shopify admin

About the Author

Matej Kontros is an E-Commerce expert and app developer with over a decade of professional experience in IT.

Matej has worked for organisations of all types and sizes, including global players, startups, and agencies. He designed, developed, and maintained complex projects.

Matej's expertise includes e-commerce, software engineering, web development, systems administration, internet security, managing projects, and building teams.

Visit his website at [ Web Linkedin ] or contact him at [email protected].