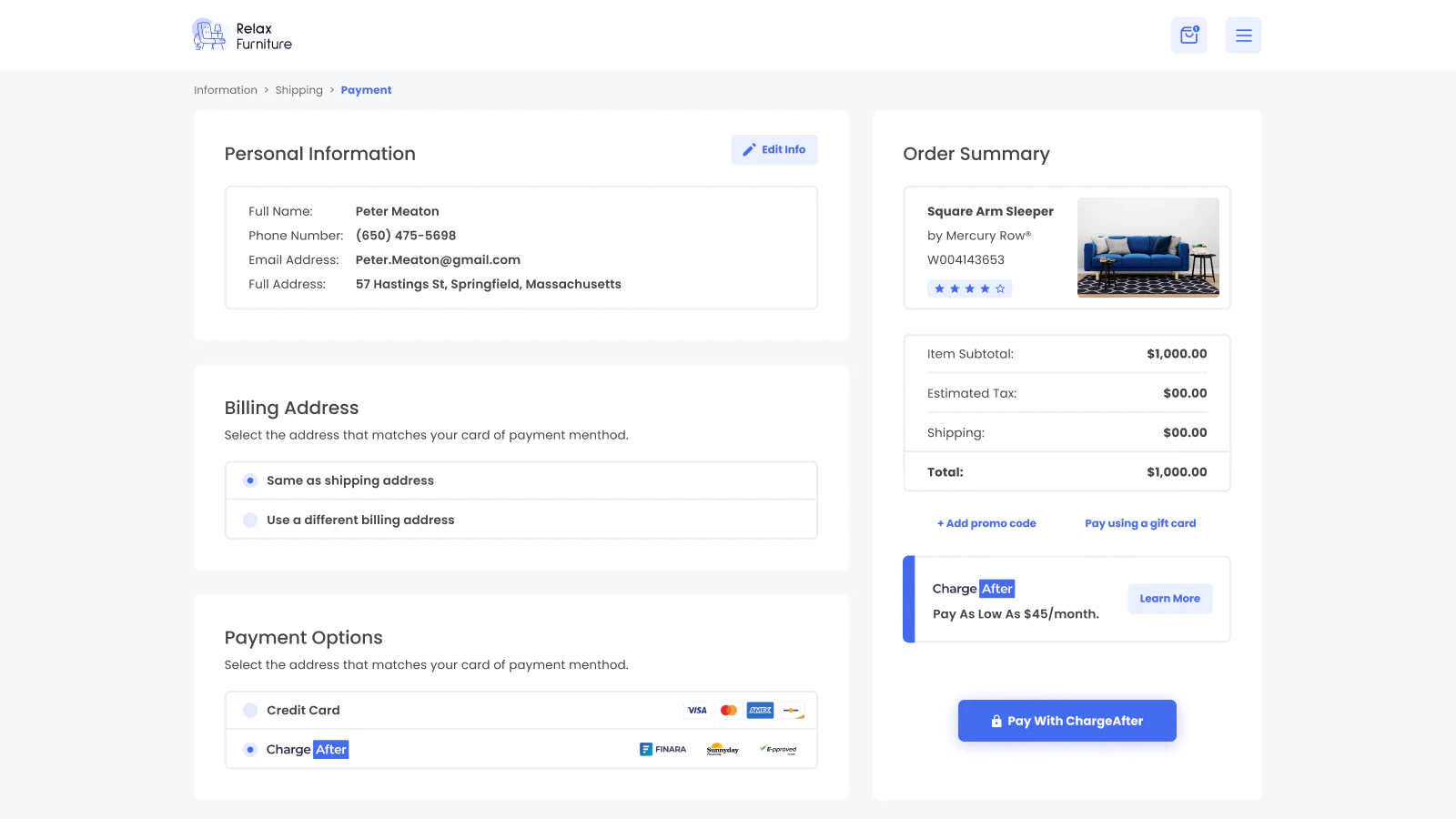

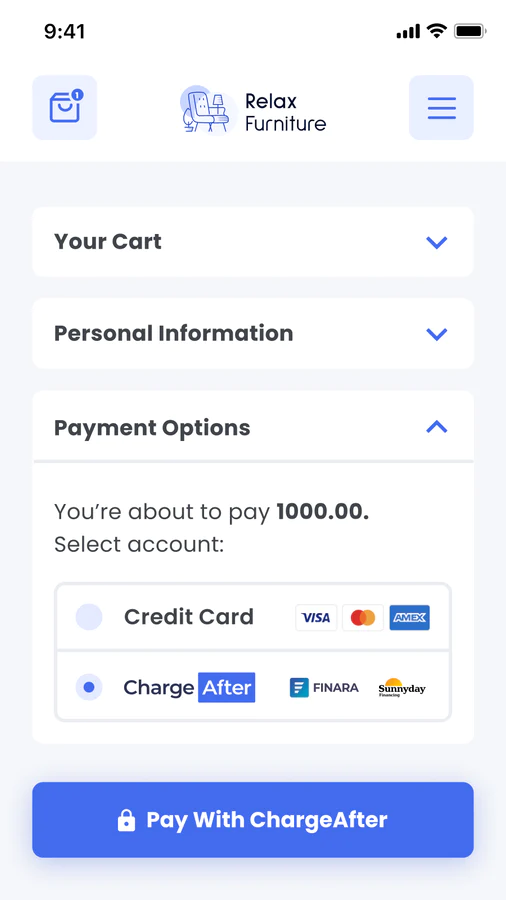

Shopify App : Consumer Financing

Point of sale financing, installments and BNPL

POS financing, installments and BNPL for Shopify.

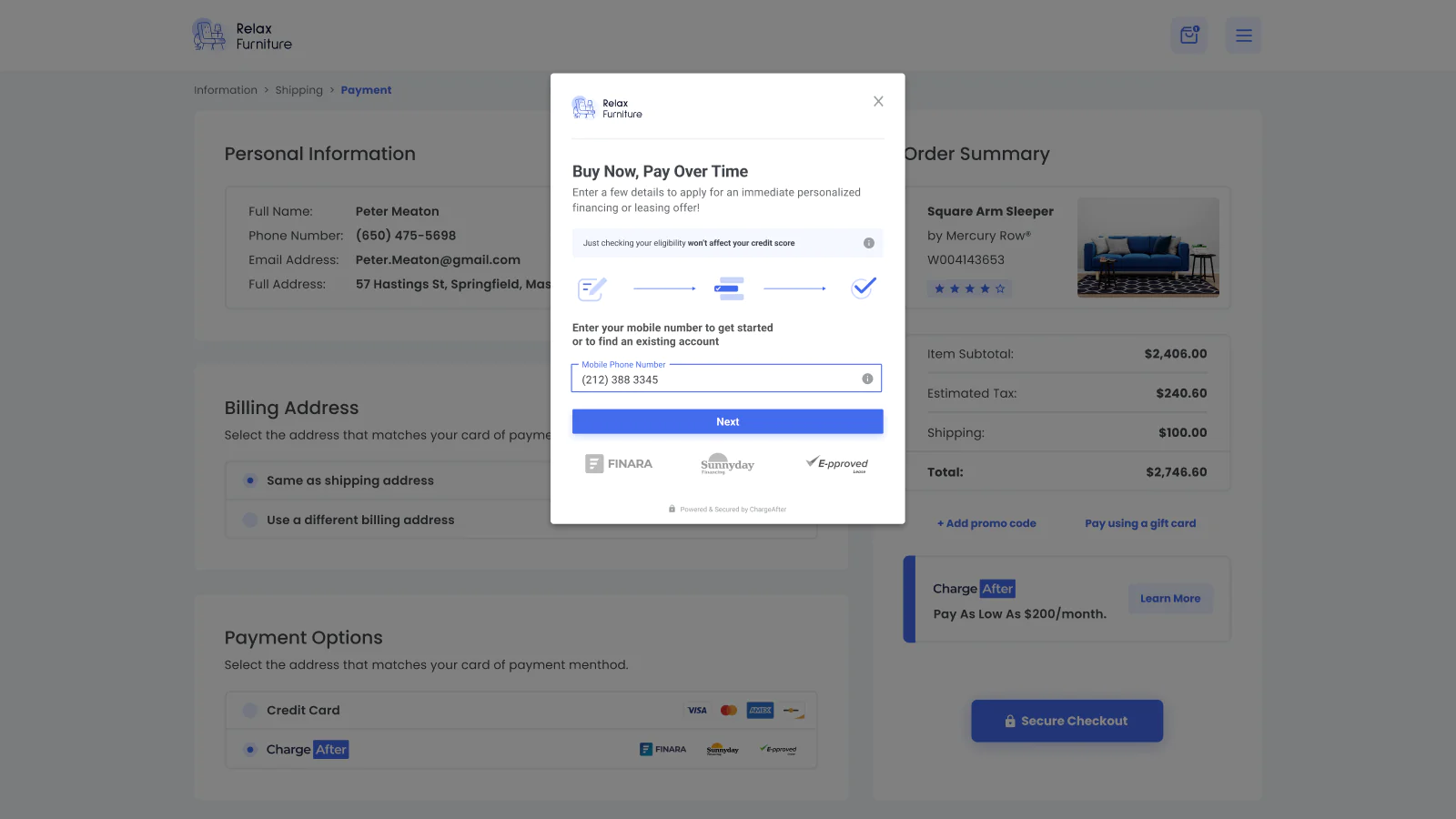

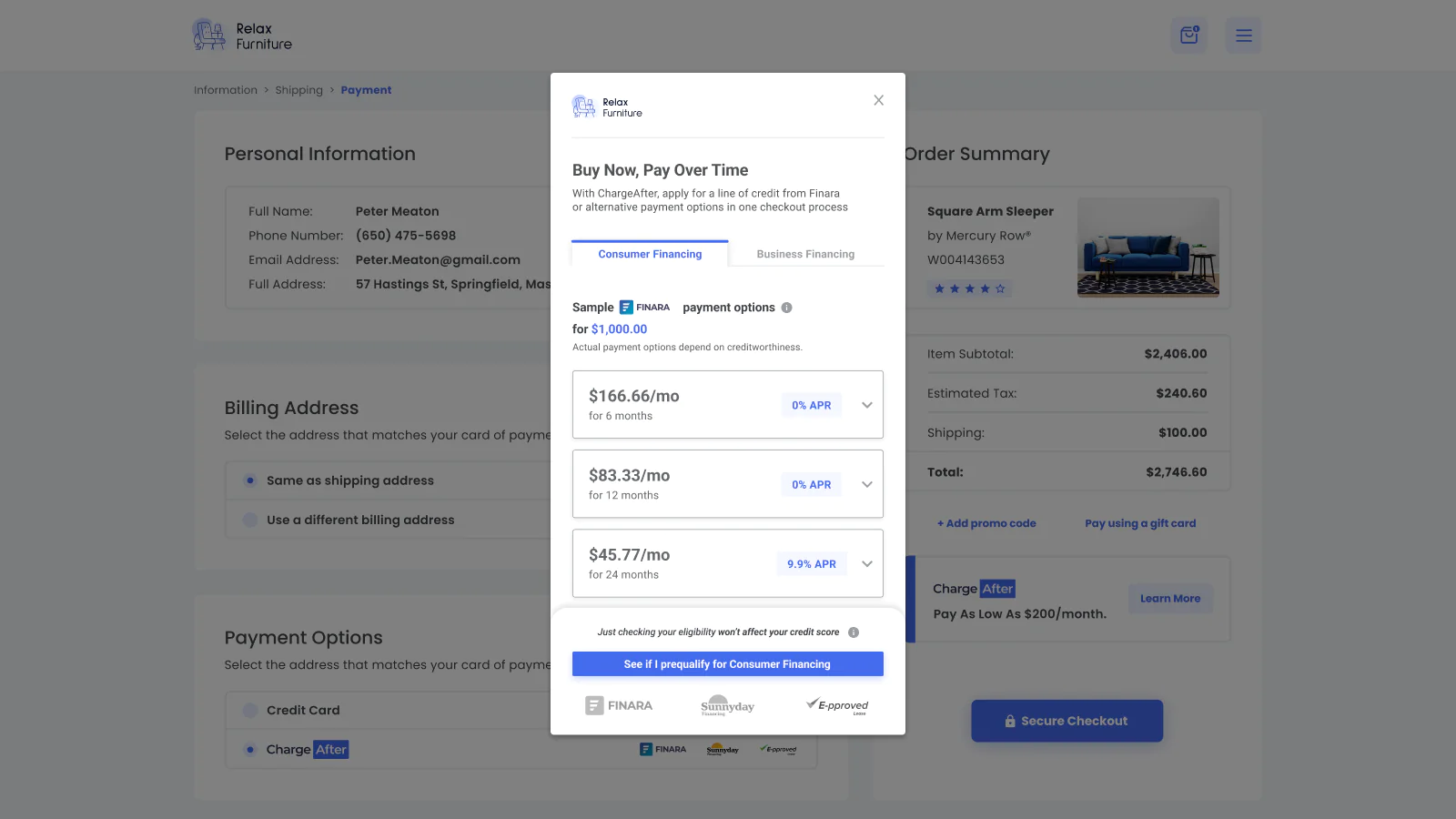

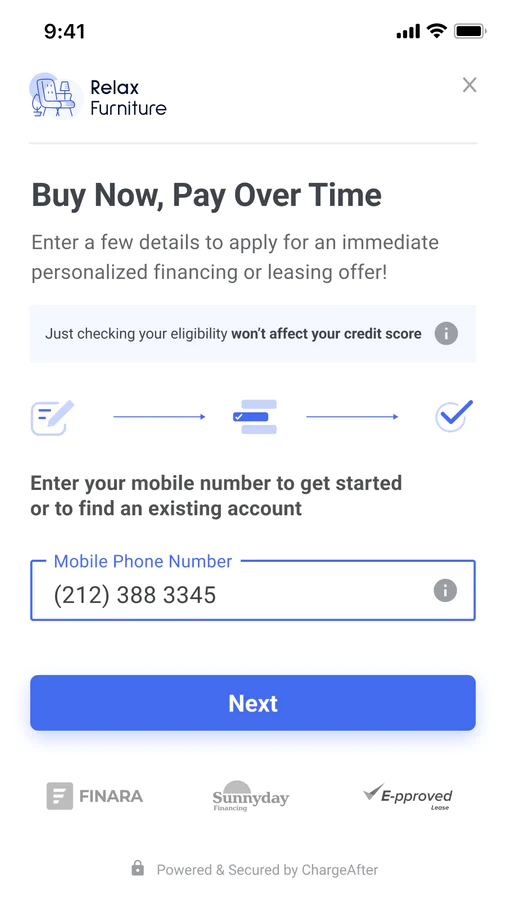

ChargeAfter is a market-leading consumer financing platform that connects retailers and lenders to offer consumers personalized Point of Sale Financing options during shopping and at checkout from multiple lenders.

Through our growing network of global lenders, Shopify retailers can approve up to 85% of consumer financing applications in real-time.

One platform, multiple lenders. One application, 85% approvals!

- Online, In-store and Call center

- 10+ lenders

- Prime lenders (For shoppers with great to good credit)

- Near prime lenders (For shoppers with OK to average credit)

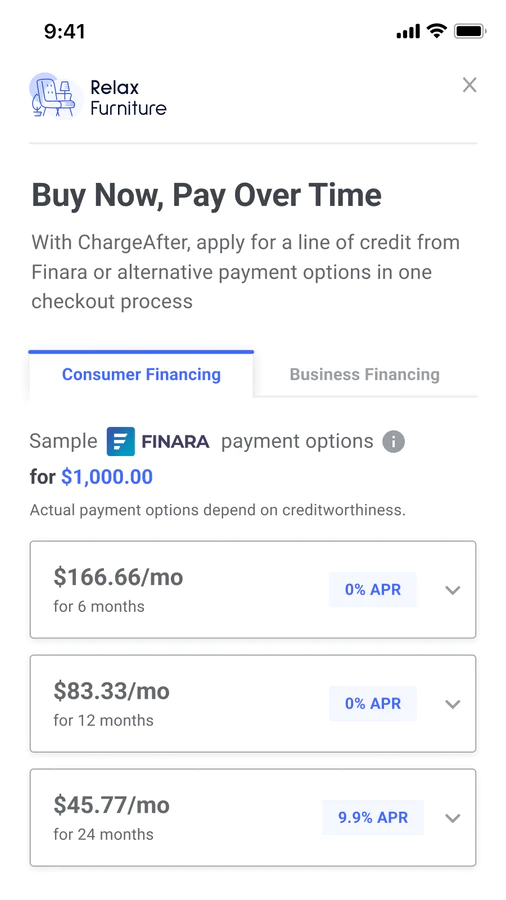

- BNPL "Pay in 4"

- 0% APR deferred interest

- 6-60 Month installments

- Revolving lines of credit

- Visa installments

Seamless workflow: use directly in Shopify admin

About the Author

Matej Kontros is an E-Commerce expert and app developer with over a decade of professional experience in IT.

Matej has worked for organisations of all types and sizes, including global players, startups, and agencies. He designed, developed, and maintained complex projects.

Matej's expertise includes e-commerce, software engineering, web development, systems administration, internet security, managing projects, and building teams.

Visit his website at [ Web Linkedin ] or contact him at [email protected].